Rental Property ROI Calculator: Maximize Your Dubai Investment

So, you're ready to dive into Dubai's electrifying property market? That's fantastic! But the real secret to success isn't just about picking a property with a stunning view; it’s about mastering the numbers. Think of a rental property ROI calculator as your secret weapon. It’s the one tool that will shift your strategy from wishful thinking to a rock-solid, data-backed plan, turning you into a confident, savvy investor.

Your First Step to Smart Dubai Property Investing

Stepping into the world of Dubai property investment is an incredible feeling. The city is buzzing with potential, from stylish apartments in the heart of Business Bay to serene family villas in Dubai Hills Estate. But the investors who truly succeed know something crucial: the real gold is buried in the spreadsheet, not just the location.

Before you even dream of touring a Dubai Studio Apartment for sale or that gorgeous villa you've been eyeing, your first step should be to get comfortable with financial analysis. It's about looking past the shiny price tag to understand the full financial story. This is where a great rental property ROI calculator becomes your most valuable partner.

Getting to Grips with the Key Numbers

At its core, Return on Investment (ROI) is a beautifully simple, yet powerful, metric. It cuts through the noise and tells you exactly how much profit your investment is generating compared to what you put in. A proper calculation really boils down to two main things:

- Your Total Investment: This is much more than the purchase price! We're talking about all the initial cash you need—think Dubai Land Department (DLD) fees, your real estate agent's commission, and any costs for getting the property ready for tenants.

- Your Net Annual Income: This is the money you actually pocket. It’s your total yearly rent after you've paid all the bills to keep the property running. This includes service charges, maintenance funds, and any property management fees.

Nailing these two components is critical. So many first-time investors get starry-eyed about the potential rent, completely forgetting the ongoing expenses that chip away at their returns. It’s a rookie mistake that can quickly turn a "great deal" into a money pit.

An accurate ROI calculation is your financial compass. It points you toward properties that don't just pay the bills but actively build your wealth for the long haul. It’s how you find those gems with the potential for a high ROI of 10% or even more.

Why You Need a Sharp Eye in the Dubai Market

Dubai's property market is unique—in the best way possible! The lack of personal income and capital gains taxes creates an amazing landscape for investors, especially when you compare it to the tax burdens in many European countries. This is a massive perk that any good expat property guide will shout from the rooftops, as UAE laws which favor expats buying are a significant draw.

But don't let that make you complacent. To find the highest ROI property in Dubai, you have to do your homework. A calculator gives you the power to compare totally different opportunities side-by-side. You can pit luxury properties in Dubai Marina against a more budget-friendly option in Al Jaddaf and see which one truly performs better on paper. It lets you play with the numbers, project your cash flow, and ultimately, invest with the sharp clarity you need to win in this world-class real estate market.

Getting Your Numbers Straight: The Foundation of a Killer ROI

Alright, let's talk about the secret to getting a reliable number from any rental property ROI calculator: you have to feed it good data. Garbage in, garbage out! To get a truly accurate picture, we have to look past the shiny purchase price and get into the nitty-gritty of every single dirham you’ll spend.

This isn’t just about what you pay on day one; it's about the ongoing costs, too. Let's break down the two buckets of numbers you absolutely have to nail down. Getting this right is your first big win.

Your All-In Initial Investment

This is the total cash-out-of-pocket required to get the keys and have the property ready for its first tenant. It's always more than the price on the sales agreement. Forgetting these extra costs is a common mistake that leads to nasty surprises and a skewed ROI.

Here’s what you need to tally up for your total initial investment:

- The Full Purchase Price: The big number you agreed on.

- Dubai Land Department (DLD) Fees: This is a big one: 4% of the property price.

- Agency Fees: Usually 2% of the purchase price.

- Registration and Other Fees: A collection of smaller administrative costs.

- Furnishing and Setup: The cost to furnish the place to attract your target tenant.

Let’s put this into perspective. For a Dubai townhouse for sale listed at AED 2,000,000, your upfront cost isn't just AED 2M. Once you add DLD and agency fees, you're already at AED 2,120,000—before furniture!

The Ongoing Costs of Doing Business

Once you own the property, the spending doesn't stop. These recurring expenses eat into your rental income. A good expat property guide will always hammer this point home: you have to forecast these numbers accurately.

An investor's biggest blind spot is often underestimating the day-to-day running costs. Factoring in every expense, from service charges to potential vacancies, is what separates an amateur forecast from a professional one.

Here are the key ongoing expenses for your ROI calculator:

- Annual Service Charges: These cover upkeep of amenities like pools and gyms. They vary a lot between communities like Dubai Marina and Downtown Dubai, so always get the exact figure.

- Property Management Fees: If you hire a pro, they'll typically charge 5-8% of the annual rent.

- Maintenance Fund: A pro move is setting aside 1-2% of the property's value each year for repairs.

- Vacancy Provision: No property is occupied 100% of the time. Budget for at least one month of vacancy per year.

- Utilities (if not paid by the tenant): For long-term rentals in Dubai, the tenant usually covers DEWA, but be aware of this.

When you meticulously gather these figures, you build a rock-solid financial foundation for your analysis. This approach transforms a rental property ROI calculator from a guessing game into a powerful tool, pointing you toward the highest ROI property in Dubai.

How to Realistically Forecast Your Rental Income

When you're running the numbers, guesswork is your worst enemy. To get an accurate number for your rental property ROI calculator, you have to anchor your forecast in the hard reality of the current market.

Your first move is to become a detective. Dive deep into property portals and see what similar properties are actually renting for right now. Let's say you’re looking at a sleek Dubai Studio Apartment for sale in Business Bay. Get granular, comparing other units in that specific area. Pay attention to building age, view, furnishings, and amenities—the details tenants care about.

Factoring in the Reality of Vacancy

Once you have a target monthly rent, it's time for a reality check. Your property will not be occupied 365 days a year. This is where occupancy rates come into play. I always advise a conservative approach. For a long-term rental, budgeting for at least one month of vacancy per year is a smart financial buffer.

The UAE market is incredibly dynamic. For example, nearby Abu Dhabi's short-term rental market shows a median occupancy rate of around 66%, with properties booked for about 241 nights annually. This translates to an impressive average annual revenue of AED 121,877 (roughly $33,209), driving home how vital occupancy is to your bottom line. You can explore more detailed data on regional rental performance to get a feel for the market.

The Big Decision: Long-Term vs. Short-Term Rentals

This brings us to a pivotal choice: long-term tenants or short-term holidaymakers?

- Long-Term Rentals: Your bread and butter for predictable, stable income. Lower tenant turnover and less management headache.

- Short-Term (Holiday) Rentals: Where you can unlock significantly higher nightly rates in tourist magnets like Dubai Marina or Downtown Dubai. While you might see a high ROI of 10% or more, be prepared for more active management and higher costs.

Your choice between long-term stability and short-term potential directly impacts the income side of your ROI equation. Be brutally honest with yourself about how much time and energy you're willing to commit.

Ultimately, a solid income forecast is built on hard data, local trends, and a clear strategy. Nailing this part means the "Income" figure you plug into that rental property ROI calculator is one you can actually bank on.

The Formulas That Drive Your Investment Decisions

Alright, you’ve gathered all your numbers. Now for the fun part! This is where we turn that data into the single most important number for any property investor: your Return on Investment (ROI).

A good rental property ROI calculator is designed to do this heavy lifting for you, but understanding what’s happening behind the scenes is what separates the pros from the amateurs.

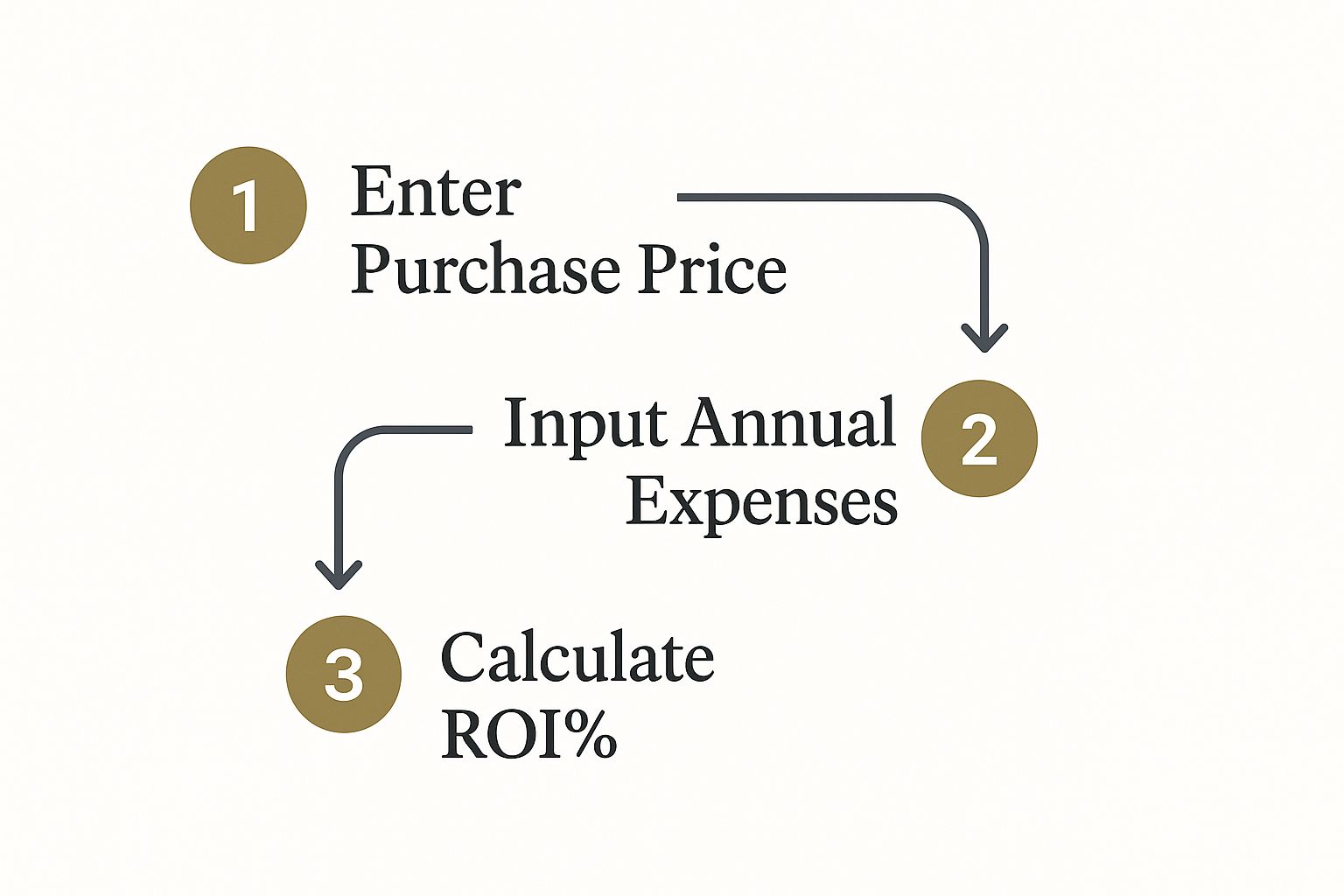

It's a straightforward path. Once you have your inputs straight, the math itself is simple and tells a powerful story.

First, Let's Figure Out Your Net Operating Income

Before we jump to ROI, we need to calculate your Net Operating Income (NOI). I like to think of NOI as the property's pure earning power before you factor in your mortgage.

The formula couldn't be simpler:

Gross Rental Income – Total Annual Operating Expenses = Net Operating Income (NOI)

Next Up: The All-Important Capitalization Rate

Once you've got your NOI, you can find the Capitalization Rate (Cap Rate). The Cap Rate is the metric seasoned investors use to instantly compare different properties on an apples-to-apples basis, ignoring financing.

Here’s how you get it:

NOI / Total Property Cost = Cap Rate

A higher Cap Rate is generally a fantastic sign. It’s essential when you're weighing a Dubai Property for sale in a hot area like Al Jaddaf against another one across town.

The market here is buzzing. The real estate market in the Middle East and Africa hit USD 217.3 billion and is expected to rocket to USD 326.6 billion by 2030. Residential is where the explosive growth is, with attractive rental yields between 5% to 7% in the UAE's best markets. You can dig into the regional real estate trends to get the full picture.

The Final Verdict: The True ROI Formula

And now, for the main event! The full Return on Investment calculation. This measures your profit against the actual cash you pulled out of your pocket.

This is the formula that ties it all together:

Annual Net Profit / Total Cash Investment = ROI

Your Annual Net Profit is your NOI minus your yearly mortgage payments. Your Total Cash Investment is every dirham you paid upfront—your down payment, DLD fees, agent commissions, the works.

Sample ROI Calculation for a Dubai Apartment

Imagine we're looking at a one-bedroom apartment in Dubai. Here's how the numbers might break down.

| Metric | Calculation/Value | Notes |

|---|---|---|

| Gross Rental Income | AED 80,000 / year | Based on current market rates. |

| Operating Expenses | – AED 15,000 / year | Includes service charges, maintenance, and vacancy buffer. |

| Net Operating Income (NOI) | AED 80,000 – AED 15,000 = AED 65,000 | This is the property's profit before the mortgage. |

| Annual Loan Payments | – AED 30,000 / year | Your yearly mortgage principal and interest. |

| Annual Net Profit | AED 65,000 – AED 30,000 = AED 35,000 | The actual cash profit you'll see in your bank account. |

| Total Cash Investment | AED 400,000 | Down payment, DLD fees, agent commission, etc. |

| Final ROI | (AED 35,000 / AED 400,000) * 100 = 8.75% | Your cash-on-cash return! |

As you can see, that final ROI percentage is your ultimate benchmark. It’s the number that tells you exactly how hard your cash is working for you, empowering you to pinpoint and secure the highest ROI property in Dubai.

Thinking Beyond ROI to Long-Term Growth

A fantastic annual return feels great, but the smartest investors play the long game. The number from a rental property ROI calculator is just the first chapter. The secret to building serious wealth in Dubai is focusing on long-term growth and capital appreciation.

Your total return isn't just about rent checks. It’s about the growing value of the property itself. This is where a good investment becomes life-changing.

The Power of Capital Appreciation

Your property isn't just paying you; it's getting more valuable. That’s the magic of capital appreciation. When sizing up a Dubai Property for sale, you must factor in this potential growth.

In a dynamic market like Dubai's, aiming for a high capital appreciation of 5-6% per annum is a realistic target. When you add this to your annual rental ROI, the picture gets more exciting. Suddenly, that solid 7% rental ROI is actually a total return of over 12% a year once you account for its rising value. This dual-engine approach is key to spotting the highest ROI property in Dubai.

A Market Built for Investor Success

Beyond the numbers, Dubai’s entire system is set up to protect and support investors. This is a massive advantage you don't find in other global cities.

Look at these game-changing perks for investors:

- Tax-Free Environment: This is a big one. The impact of taxes in property investment is minimal here. The lack of annual property taxes for individuals means what you earn, you keep. It’s a huge boost to your net returns.

- Favourable UAE Laws: Programs like the Golden Visa give long-term residency to property investors, providing incredible stability. This legal framework is a core part of the expat property guide to success, as UAE laws which favor expats buying as opposed to other GCC and European countries make it simpler and more secure for foreigners to own assets here.

The Middle East’s real estate market is booming, fueling both rental yields and property values. The residential sector, which already makes up 45.3% of the regional market, is projected to nearly double to USD 799.46 billion by 2033, growing at a rate of 8.31%. Discover more about this incredible market expansion.

This growth is like a rising tide that lifts all ships. When you understand these long-term forces, you're making strategic decisions that can build wealth for generations.

Common Questions About Dubai Property ROI

Diving into Dubai's real estate market is thrilling, but it's normal to have questions when using a rental property ROI calculator. Getting a handle on these key points will give you the confidence you need to make smart moves.

What Is a Good Rental ROI in Dubai?

This is the big one. A net yield between 5% and 8% for long-term rentals is a fantastic target in Dubai. If you’re more ambitious, targeting the short-term rental game in hotspots like Dubai Marina or Downtown Dubai, aiming for a high ROI of 10% or more is possible. Just remember, those bigger returns often come with more active management.

How Do Service Charges Affect My ROI Calculation?

Think of service charges as one of your biggest annual costs. They're non-negotiable and hit your ROI directly. These fees can vary wildly from one tower to another.

Here’s a pro tip: When using a rental property ROI calculator, never guess the service charges. Get the exact rate per square foot. Underestimating this expense is the fastest way to get an inaccurate ROI projection.

A property with lower service charges but the same rent will always deliver a better return. This is a crucial detail when you’re comparing listings for a Dubai Property for sale.

Should Capital Appreciation Be Part of My ROI Calculation?

One hundred percent, yes! While simple formulas like Cap Rate are great for a quick snapshot, they only tell half the story. Your total return is made up of two forces: the cash flow you collect and the growth in your property's value. Your annual rental yield calculation shows your cash-on-cash return. But the smartest investors always calculate their Total ROI, which factors in equity. Adding a potential high capital appreciation of 5-6% per annum on top of your rental income shows the incredible wealth-building power of Dubai real estate over time.

Ready to find your next high-yield investment? The experts at Emerald Estates Properties LLC can guide you through every step of the process, from detailed ROI analysis to securing the perfect property.

Discover premier investment opportunities at https://emeraldestates.ae.