Dubai Real Estate Market Trends: An Investor’s Guide for 2025

What’s really happening in the Dubai real estate market right now? We're witnessing a powerful combination of steady price increases, a major pivot towards luxury and branded homes, and an incredible surge of interest in prime spots like Downtown Dubai and Palm Jumeirah. Let's dive into why this is a critical moment for anyone looking to invest in Dubai's unstoppable growth and understand the key Dubai real estate market trends.

Decoding Dubai's Property Boom: Market Insights

Welcome to the heart of global real estate ambition! Dubai's property market isn't just humming along; it's firing on all cylinders, grabbing the attention of savvy investors from every corner of the world. This isn't accidental. It's the result of smart government initiatives, Dubai's solid reputation as a global safe haven for safety and security, and a continuous flow of high-net-worth individuals chasing a better lifestyle.

The city has done an incredible job of positioning itself as an island of stability in an unpredictable world. This has created a magnetic pull for everyone, from expats looking to plant roots to international investors hunting for secure assets. The result is a confident, buzzing market where demand in the best areas just keeps climbing.

To get a quick read on the market's pulse, let's look at the key indicators. This table boils down the big movements and what they mean for you as an investor.

Current Dubai Real Estate Market at a Glance

| Trend Indicator | Current Status | Key Takeaway for Investors |

|---|---|---|

| Price Growth | Sustained and steady, especially in prime areas. | Strong potential for capital appreciation, but entry points are rising. |

| Luxury Segment | Experiencing explosive demand. | Focus on high-end villas and branded residences for premium returns. |

| Expat Demand | Higher than ever, driven by favourable laws. | The market has a deep and growing pool of both buyers and tenants. |

| Rental Yields | Robust, particularly in established communities. | Excellent opportunity for reliable passive income streams, often hitting a high ROI of 10%. |

| Government Policy | Highly supportive (Golden Visa, 100% foreign ownership). | A secure and welcoming environment for international capital. |

This snapshot shows a market that's not just growing, but maturing. The fundamentals are strong, pointing towards continued stability and opportunity.

The Allure Of Luxury And High Returns

One of the most exciting trends is the incredible appetite for luxury properties in Dubai. We're talking about high-end villas and stunning apartments in top-tier communities like Dubai Hills Estate and Business Bay, which are being snapped up at a remarkable pace. This isn't just about finding a fancy place to live; it's a strategic investment play.

These properties are where the promise of high returns truly comes to life. Investors are seeing the potential for significant high capital appreciation of 5-6% per annum, and sometimes even more.

For anyone with a sharp eye for opportunity, the market today is incredibly compelling. The intense focus on luxury is a direct answer to what the new wave of affluent residents wants: unmatched quality, world-class amenities, and a sense of exclusive community.

This shift is creating a fantastic sweet spot where the right property delivers both an amazing lifestyle and serious financial rewards.

Why Expats Are Flocking To Dubai

The market's incredible strength is also directly tied to its appeal to expatriates. Dubai offers a straightforward and inviting path to property ownership, which is a breath of fresh air compared to the red tape in Europe or other GCC countries. This pro-investor attitude is a huge part of what’s driving the current trends.

So, what’s pulling expat investors in?

- Favourable UAE Laws: The chance for foreigners to have 100% freehold ownership in designated areas is a game-changer.

- Tax-Free Environment: No income tax on rental money and no capital gains tax? That’s a powerful motivator that lets investors keep more of their profits.

- Golden Visa Programme: The ability to get long-term residency by investing in property adds a valuable layer of security and makes people feel truly invested in the city.

When you mix this economic stability with a luxurious lifestyle and investor-first policies, it's easy to see why the Dubai real estate market trends tell such a powerful story of success. This is an environment practically built for growth, attracting capital and talent from all over the globe.

How Villa and Apartment Prices Are Hitting New Heights

Let's get right into the numbers, because what's happening in the Dubai real estate market right now is truly exciting. It’s more than just an upward tick; we’re seeing an incredible surge in value across the board. Both spacious villas and stylish apartments are delivering the kind of capital gains that get investors talking.

The clamour for a Dubai villa for sale has been especially intense. We're seeing a huge influx of high-net-worth individuals from around the globe who are looking for more space, privacy, and luxury. This isn't just a local trend; it's a worldwide shift, and Dubai, with its unmatched lifestyle offerings, is right at the forefront.

The Villa Boom is Real

The data doesn't lie, and the picture it paints is one of explosive growth. According to the latest analysis, villa prices have rocketed up by a stunning 29% year-on-year. That alone is impressive, but when you zoom into specific communities, the numbers are even more mind-blowing.

- Jumeirah Islands: This community is leading the charge with a jaw-dropping 41% annual price increase.

- Palm Jumeirah: Not far behind, the iconic Palm has seen villa values climb by 40%.

- Emirates Hills & The Meadows: Both prestigious areas have recorded a massive 27% growth.

These figures are simply staggering. To put it in perspective, freehold villas are now priced 66% above their previous peak in 2014 and an almost unbelievable 175% higher than they were at their lowest point after the pandemic. For anyone looking at the market, this signals a massive opportunity for high capital appreciation, often in the 5-6% per annum range, and frequently much more. You can dive deeper into these trends over at Consultancy-ME.com.

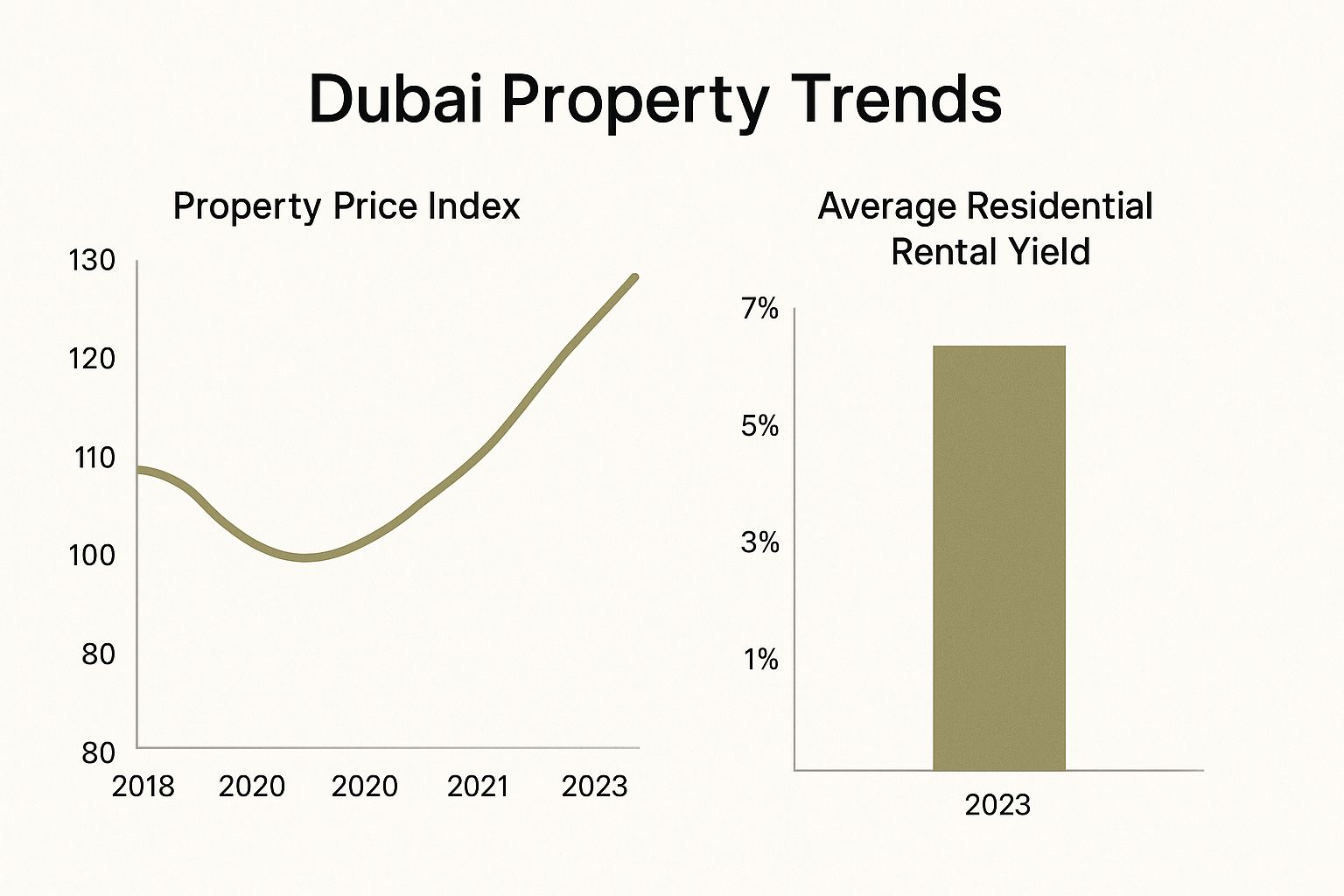

This chart really brings the story to life, showing the powerful growth in property values alongside the healthy rental yields that make this market so robust.

As you can see, it’s a story of consistent gains backed by strong rental income – the perfect combination for any savvy investor.

Apartments Are Climbing Steadily, Too

While the villa market is making headlines, don't sleep on apartments. This segment of the market is showing powerful, steady growth of its own and offers fantastic entry points for a wider range of people, including those looking for their first Dubai property for sale.

The consistent rise in apartment prices proves the depth and resilience of Dubai's housing market. It's not just a top-end boom; the demand for quality urban living is strong across the board, providing multiple avenues for investment success.

Prime apartment communities are delivering fantastic returns. We're seeing yearly capital gains hovering around 23-24% in hotspots like The Greens, Dubai Silicon Oasis, and Palm Jumeirah. Even in more affordable areas like International City, prices have seen a healthy 11% jump, proving this positive momentum is spread across the entire market.

This parallel growth in both villas and apartments is one of the key Dubai real estate market trends to watch. While most experts agree that this rocket-fuelled growth might eventually level out as supply and demand find a new equilibrium, the immediate future looks incredibly bright. The city continues to attract affluent residents, and the demand for housing remains strong. That’s the solid foundation giving investors confidence that they're putting their money in a market with real substance and fantastic potential.

Where to Find High Capital Appreciation Hotspots

Alright, we've seen the big-picture growth firing up the market. Now, let's zoom in and get our hands dirty. Think of this as your treasure map to the Dubai neighbourhoods with the biggest potential for explosive capital appreciation. Smart investing isn't just about following general Dubai real estate market trends; it's about pinpointing the specific postcodes that will work hardest for you.

Location, location, location—it’s a cliché for a reason! Whether you're chasing a solid high capital appreciation of 5-6% per annum or hunting for the next big thing, the community you choose is everything. Let's dive into the prime hotspots that are buzzing with energy and should absolutely be on every investor's radar.

Premier Communities Leading the Charge

Some postcodes in Dubai aren't just addresses; they are iconic lifestyle destinations. These are the areas that have become magnets for investment, creating vibrant ecosystems that offer powerful returns.

Dubai Marina: The Urban Waterfront Dream

For anyone who thrives on a fast-paced, electric atmosphere, Dubai Marina is the undisputed king. It’s all about that incredible skyline, the bustling promenades, and the endless stream of world-class restaurants and entertainment. This constant buzz attracts a steady flow of young professionals and expats, keeping rental demand incredibly high. An apartment here isn’t just property; it's a front-row seat to Dubai’s dynamic social scene.

Business Bay: The Professional Hub

Right next door to the glamour of Downtown Dubai, Business Bay is the city’s ambitious, beating heart. This is where the action is for professionals who want to live, work, and play all within one high-energy neighbourhood. The area is dominated by sleek, modern towers with breathtaking views and unbeatable access to major business centres. Investing here lets you tap directly into a market of career-focused individuals who value convenience and a prestigious address above all else.

The real secret to winning in property investment is matching a community's unique vibe with your personal goals. An investor focused on families will find success in a completely different area than someone targeting young professional renters. Getting this right is the key to unlocking maximum returns.

Dubai Hills Estate: The Green Heart of Luxury

If a Dubai townhouse for sale within a lush, family-friendly sanctuary is what you're after, Dubai Hills Estate is your answer. This place is a masterpiece of community planning. It’s a green oasis designed around a stunning championship golf course, complete with sprawling parks, fantastic schools, and top-notch medical facilities. It offers that perfect sweet spot between peaceful suburban living and easy city access, making it a dream for families. Unsurprisingly, demand for villas and townhouses here is rock-solid, driving consistent and impressive appreciation.

Analysing the Investment Proposition

Each of these hotspots presents a fantastic reason to invest, but their strengths cater to different strategies. Let's break down what makes them such powerful contenders.

| Community | Key Appeal | Ideal Investor Profile | Primary Property Type |

|---|---|---|---|

| Dubai Marina | Energetic waterfront lifestyle | Seeks high rental yields & steady growth | Apartments, Penthouses |

| Business Bay | Proximity to business hubs | Targets professionals & corporate tenants | Apartments, Offices |

| Dubai Hills Estate | Family-focused luxury & green spaces | Targets long-term capital appreciation | Villas, Townhouses |

This kind of strategic thinking allows you to see past the glossy brochures. When you really analyse a community’s core identity, its infrastructure, and who it attracts, you can make a much smarter, more informed decision.

Plus, ongoing projects like the expansion of the Dubai Metro and new road networks in these areas only reinforce their long-term value. It’s a guarantee they’ll stay in high demand for years to come. Ultimately, securing the best luxury properties in Dubai comes down to finding that perfect intersection where lifestyle and investment potential meet.

Understanding Dubai's Market Stability and Demand

When we talk about a healthy market, we're not just looking at rising price tags. It's about something deeper—the genuine, rock-solid confidence of everyone involved. The powerful Dubai real estate market trends we’re witnessing are built on an incredible foundation of stability and a demand that just doesn't quit.

This isn't some flash in the pan. The market's muscle is flexed every single day through the sheer volume of deals getting done. It’s a clear signal that buyers, from families putting down roots to savvy global investors, are putting their money where their mouth is, showing an unshakeable belief in Dubai's future.

The Engine of Demand is Strong and Diverse

So, what’s the secret sauce to Dubai’s property market resilience? A huge part of it is the amazing mix of people buying in. We're seeing a fantastic blend of buyers from all corners of the globe and all walks of life, which creates a dependable stream of demand that doesn't rely on just one source.

This includes:

- First-Time Homeowners: More and more residents are deciding to plant permanent roots, making that exciting leap from renting to owning their own place.

- International Investors: Global capital keeps flowing into the city, drawn by the security and impressive returns that Dubai consistently delivers.

- Existing Residents Upgrading: As families grow and careers flourish, people are always looking to upgrade their homes and lifestyles, which keeps the mid-range and luxury segments buzzing.

This diverse base of buyers acts like a fantastic shock absorber. It helps the market hold steady, even when the global economy gets a little turbulent. It's this multifaceted demand that truly sets Dubai apart from more volatile, speculative markets.

The Numbers Tell a Story of Confidence

You don't have to take my word for it—the data speaks volumes. In a recent quarter alone, Dubai’s residential market saw a staggering 42,000 sales transactions. That’s not just a number; it’s a roaring vote of confidence.

And it wasn't just about volume. Average sales prices also climbed by 2.8% quarter-on-quarter and hit an impressive 15.8% increase year-on-year. This highlights the kind of steady price appreciation that has become a hallmark of the market. You can dive deeper into the data behind this stellar performance over at Cavendish Maxwell.

Even with a slight dip one month, the market quickly rebounded, keeping the average quarterly growth rate at a very healthy 4%. This points to a market that is maturing beautifully. We're moving beyond the explosive growth of the past and into a more stable, sustainable phase where growth is still strong, but more measured.

The sheer consistency of demand, even as prices moderate, is the clearest indicator of a mature and stable market. Investors should see this not as a slowdown, but as a sign of long-term health and sustainability.

This stability is absolutely critical for anyone looking beyond a quick flip. It's for those who want a secure environment where their capital is protected and has the room to grow steadily over time. It’s definitive proof of the market's resilience and maturity.

Building a Fortress of Buyer Confidence

This incredible market confidence didn't just happen by accident. It's been meticulously built through smart government policies and seriously attractive developer offerings.

One of the biggest game-changers has been the creative approach to payment plans. Developers have gotten incredibly flexible, offering post-handover payment plans that make it so much easier to get into the market. This helps first-time buyers get their foot on the property ladder and allows investors to manage their cash flow much more effectively. Think of it as a financial safety net that encourages more people to jump in.

At the same time, government programmes like the Golden Visa have been revolutionary. By linking long-term residency directly to property investment, the government has given expats and international investors a compelling reason to buy luxury properties in Dubai and commit to the city for the long haul.

This powerful one-two punch of accessible financing and residency security has built a true fortress of buyer confidence, creating a self-reinforcing cycle of sustainable growth and proving the market’s fundamental strength.

Is the Dubai Property Market Hitting a Plateau?

After an incredible, multi-year sprint of growth, the question on every investor’s mind is a big one: is this the peak? Let’s be clear, knowing where you stand in the market cycle is everything when it comes to making smart moves. And the latest Dubai real estate market trends are pointing to a fascinating shift—not a stop, but a definite change in pace.

The market is showing all the classic signs of maturing. Those wild, double-digit price hikes that made headlines are gracefully giving way to more controlled, sustainable gains. This isn't a red flag. Far from it! It’s the sign of a market transitioning from a breathless sprint to a confident, steady marathon. And honestly, this evolution is bringing a whole new set of opportunities for those who know where to look.

A New Phase of Sustainable Growth

For savvy investors, this shift is incredibly exciting. It signals a move away from the frantic world of speculative, short-term flips and towards building real, long-term wealth on a solid foundation. That intense growth phase did its job perfectly, and now the market is settling into a much more predictable, and frankly, healthier rhythm.

The data backs this up completely. After an astounding run of price growth that lasted 51 straight months, property prices hit an average of AED 1,484 per square foot. To put that in perspective, that’s 20.3% above the previous market peak—a testament to how powerful this cycle has been. But then, we saw the first month-on-month price dip in over two years, a clear signal that a plateau might be forming. You can dig into the specifics in the full monthly report on Property Monitor.

While the last cycle saw monthly price appreciation average an impressive 1.19%, the pace has definitely cooled. After hitting a high of 2.48% in a single month, gains slowed to under 1% near the end of the year. This slowdown is the market telling us it’s entering a more mature and stable phase.

Affordability Becomes the New Driver

So, what's behind this change in momentum? It really boils down to one word: affordability. As prices have soared, especially for ready properties, buyers are naturally becoming more price-sensitive. This isn't a problem; it's a healthy and necessary market correction.

This affordability crunch is reshaping how people buy property, and that’s changing the entire market. Here’s what it means for you as an investor:

- Realistic Expectations: The days of banking on 20-30% annual gains are likely on pause. The focus is shifting to achieving a solid and sustainable high capital appreciation of 5-6% per annum.

- Off-Plan Shines: With the ready market getting pricier, more buyers are turning their attention to off-plan properties. These often come with much more attractive pricing and flexible payment plans, making them the new hot ticket.

- Spotting Niche Value: This is where the real skill comes in. This phase rewards investors who can dig deeper to find hidden gems—maybe in an up-and-coming neighbourhood or a property with unique features that justify a premium.

A mature market doesn't mean the opportunities are gone; it means they've changed. The game is no longer about just riding a wave of rising prices. It's about strategic selection and a deeper understanding of value.

For anyone eyeing luxury properties in Dubai, this means zeroing in on assets with truly enduring appeal. Think prime locations like Downtown Dubai or properties offering unique lifestyle perks that will hold their value no matter what the market does in the short term. This shift in dynamics is a call for smarter, more strategic investing, and it’s going to reward those who adapt their game plan to this exciting new phase of stability.

So, Why Are Global Investors and Expats Flocking to Dubai?

It’s about so much more than impressive market charts and shiny new buildings. The real magnetic pull of Dubai is a powerful combination of genuine opportunity, unmatched security, and a lifestyle that's hard to beat. For savvy investors and expats from around the world, this city isn't just a place to park their capital; it's a place to build a better future.

Think of this as your essential Expat property guide. We're going to break down exactly what makes Dubai the world’s go-to destination for property investment right now.

At the very core of this appeal are the incredibly favourable UAE laws which favour expats. Honestly, compared to the tangled and often frustrating rules you'll find in many European countries or even neighbouring GCC nations, Dubai basically rolls out the red carpet. This welcoming attitude is a huge driver behind the current Dubai real estate market trends.

The entire legal system feels like it was designed to empower you, not hold you back. It offers a level of freedom and security that's just a different league on the global stage, giving investors every reason to make their next big move right here.

A Legal Framework That Actually Works for Investors

Dubai’s famous pro-business mindset really shines through in its property laws. They are refreshingly clear and direct. If you’re tired of battling bureaucratic red tape just to buy a property, you’ll find the city’s straightforward path to ownership a breath of fresh air.

Here are the game-changing legal advantages that really make Dubai stand out:

- You Own It, 100%: In designated freehold zones—we’re talking prime spots like Downtown Dubai, Dubai Marina, and Dubai Hills Estate—expats can own property outright. This isn't some complicated lease agreement; it’s full, unambiguous ownership. You have total control over your asset.

- A Golden Ticket to Residency: The UAE's Golden Visa programme is a true game-changer. By investing AED 2 million or more into a property, you can secure a 10-year renewable residency visa for you and your family. Suddenly, a simple property purchase becomes a long-term plan for living, working, and thriving in the UAE.

- Say Goodbye to Property Taxes: This is probably the most compelling perk of all. In Dubai, there are no annual property taxes, no tax on rental income, and no capital gains tax when you decide to sell. This tax-free environment means you keep what you earn, directly boosting your returns and making the numbers look very attractive.

This investor-first legal structure isn't just a policy; it's a powerful statement of intent. Dubai is serious about attracting and retaining global capital, providing a stable and highly profitable environment that builds lasting confidence.

To really put this into perspective, let's see how Dubai's framework stacks up against other regions.

Property Investment Framework Dubai vs Other Regions

Here's a quick comparison that highlights just how uniquely investor-friendly Dubai is compared to other popular global markets.

| Investment Factor | Dubai (UAE) | Typical European Country | Other GCC Countries |

|---|---|---|---|

| Foreign Ownership | 100% in Freehold Zones | Often restricted or complex | Highly restricted, limited to certain nationals |

| Residency Visa | Yes (Golden Visa for property owners) | Difficult, long process | Very limited or non-existent |

| Rental Income Tax | 0% | Can be as high as 45%+ | Varies, but often taxed |

| Capital Gains Tax | 0% | Often 15-35% or more | Can be applicable |

The table makes it crystal clear. The combination of complete ownership, long-term residency, and a zero-tax environment is a trifecta you just won't find elsewhere. This is what gives investors the confidence to go all-in on the Dubai market.

It's More Than an Investment—It’s a Lifestyle Upgrade

While the financial incentives are undeniably powerful, Dubai's true magic is the incredible quality of life it offers. People don't just invest here; they genuinely want to live here. The city consistently ranks as one of the safest in the world, with world-class infrastructure that makes daily life feel seamless and effortless.

From pristine public beaches and sprawling green parks to Michelin-starred restaurants and global entertainment events, Dubai delivers a lifestyle that is both exciting and incredibly convenient. It’s this vibrant, secure, and multicultural atmosphere that ultimately convinces so many people to turn a property investment into their forever home.

This is what fuels the sustained demand for both rentals and sales across the market. It’s why a Dubai property for sale is always more than just an asset—it's an investment in a better way of life.

Got Questions? We've Got Answers

Thinking about jumping into the Dubai property market? You're not alone. Here are some of the most common questions we get from investors just like you. Let's clear up the big ones so you can move forward with total confidence.

Can I Really Get a High ROI on a Property in Dubai?

You absolutely can. In fact, seeing a high ROI of 10% or even more isn't just a possibility; it's a reality for many savvy investors here.

So, what's the secret sauce? It’s all about finding properties in hotspots with relentless rental demand. Think about a Dubai studio apartment for sale in places that are always buzzing, like Dubai Marina, JVC, or Business Bay. These areas are magnets for young professionals and expats, meaning you'll have a steady stream of tenants lining up. Another fantastic strategy is getting in early with off-plan properties—buying them at a great price before they're built can lead to incredible returns once they're handed over.

What Are the Property Taxes for Expats in Dubai?

This is where Dubai truly shines and one of its biggest draws for global investors. When you compare it to other major cities, the tax situation here is a dream.

The beauty of Dubai's system is its simplicity. You won't face any annual property taxes, there's zero income tax on the rent you earn, and no capital gains tax to worry about when you decide to sell. It’s a game-changer.

The main fee you need to budget for is the one-time Dubai Land Department (DLD) transfer fee. This is set at 4% of the property's value and is paid when you complete the purchase. That’s it!

What Visa Can I Get if I Buy Property in Dubai?

Your property investment isn't just a financial asset; it's your ticket to living in the UAE. The government has rolled out the red carpet for investors, making it easier than ever to call Dubai home.

Here’s how it breaks down:

- 2-Year Investor Visa: Purchase a property valued at AED 750,000 or more, and you're eligible to apply for this renewable residency visa.

- 10-Year Golden Visa: For a more significant investment in property valued at AED 2 million or more, you can secure the highly sought-after Golden Visa. This offers long-term residency and a host of fantastic benefits for you and your family.

Keeping up with Dubai real estate market trends is a lot easier when you have an expert in your corner. At Emerald Estates Properties LLC, we live and breathe luxury real estate and are passionate about delivering outstanding service. Let's explore what's possible together. Visit us at https://emeraldestates.ae to get started.