How to Buy Property in Dubai: An Expat’s Guide

Thinking about buying property in Dubai? It’s a lot more straightforward than you might imagine, even for expats. It boils down to knowing the designated freehold zones where foreigners can own property, getting your finances in order, and smoothly navigating the process with the Dubai Land Department. It’s a journey that blends incredible investment potential with a world-class lifestyle.

Why Dubai Is a Global Property Hotspot

If you're asking "how do I buy property in Dubai?", you're joining a global community of smart investors drawn to this city. Dubai’s real estate scene is more than just fancy skyscrapers; it’s built on incentives that make it a magnet for buyers.

Unlike many other international hubs, the UAE has rolled out the red carpet for foreign investors. The introduction of freehold ownership zones was a game-changer, allowing non-residents to buy, own, and sell property in sought-after locations without a local partner. This is one of the key UAE laws which favour expats buying as opposed to other gcc and european countries, offering total peace of mind.

Understanding Freehold vs Leasehold

One of the first things to understand is the difference between freehold and leasehold.

- Freehold: This gives you absolute ownership of the property and the land it’s built on. You can sell it, rent it out, or pass it down. Think of iconic communities like Dubai Marina, Downtown Dubai, and Dubai Hills Estate—these are prime freehold territories.

- Leasehold: This option gives you the right to use a property for a very long time, usually up to 99 years. You own the building but not the land.

For most international buyers, freehold is the way to go for its complete control and long-term security.

The Financial Appeal for Expats

Dubai’s pro-investment environment is a massive draw. The absence of annual property taxes, zero income tax on rental earnings, and no capital gains tax means more of your money stays in your pocket. This incredible tax efficiency boosts your overall returns, making a Dubai property for sale an incredibly attractive asset.

The numbers don't lie. Government initiatives keep the market dynamic, attracting everyone from first-time buyers to seasoned investors. This sustained growth points towards a serious potential for high capital appreciation of 5-6% per annum, on top of some of the best rental yields anywhere.

This tax-friendly environment is a core part of the impact of taxes in property investment in Dubai. It allows investors to maximize their net returns in a way that's difficult to match elsewhere.

Getting Your Finances and Paperwork in Order

This is where the dream becomes reality. Navigating the money and legalities in Dubai is surprisingly clear-cut.

First, decide how you are paying: cash or mortgage. Being a cash buyer gives you an advantage, allowing you to move fast and negotiate better deals. When the perfect property pops up, acting immediately can make all the difference.

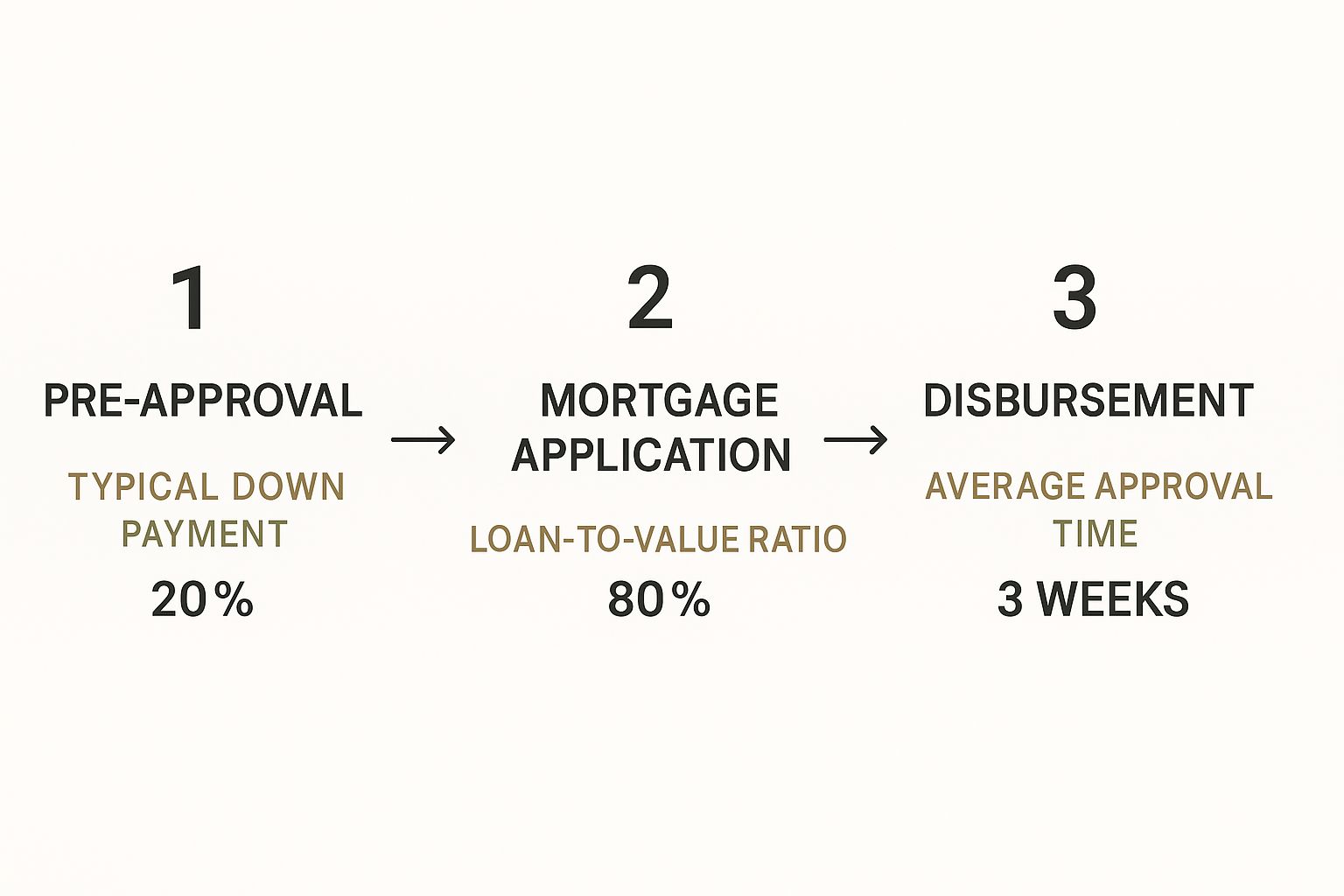

How to Get a Mortgage as an Expat

If you're financing, you're in luck. Dubai's banks are well-versed in working with expats. Typically, you'll need a down payment of at least 20-25%. The banks will want to see proof of steady income and a decent credit history.

Here’s a quick look at the documents you’ll need:

- Passport and Visa Copies

- Proof of Address (e.g., utility bill)

- Bank Statements (last six months)

- Salary Certificate or Proof of Income

My advice? Get pre-approved before you start viewing properties. It gives you a solid budget and shows sellers you're a serious buyer.

Hitting the Key Legal Milestones

Once your finances are lined up, there are a couple of key legal steps. The system is built on transparency and security.

A crucial document for resale properties is the No Objection Certificate (NOC). The developer issues this to confirm all service charges are paid, protecting you and ensuring you get a property with a clean slate.

Finally, you must work with a real estate agent registered with the Real Estate Regulatory Agency (RERA). Choosing a RERA-certified agent from a trusted brokerage like Emerald Estates Properties LLC means you're partnering with a professional bound to protect your interests. This expert guidance makes buying property in Dubai a secure and straightforward experience.

Finding Your Perfect Dubai Property

Now for the fun part—the hunt for your new place. Whether you're dreaming of a sleek Dubai studio apartment for sale with views of the Burj Khalifa, or a sprawling Dubai villa for sale in Jumeirah Golf Estates, the options are endless.

The first big question is: off-plan or ready property? This choice sets the tone for your investment journey.

Off-Plan vs. Ready Properties

Buying off-plan means purchasing directly from a developer before the property is built. The big draw is often a lower price and flexible payment plans, offering potential for high capital appreciation of 5-6% per annum as the project develops.

On the flip side, a ready property is about instant gratification. What you see is what you get. The moment the keys are in your hand, you can either move in or start earning rental income. For investors chasing a high ROI of 10% right out of the gate, this is a massive advantage.

| Feature | Off-Plan Property | Ready (Resale) Property |

|---|---|---|

| Price Point | Often lower, with developer incentives. | Based on current market value. |

| Payment Structure | Staggered payment plans. | Full payment required at transfer. |

| Capital Growth | High potential as the project develops. | Tied to established market trends. |

| Rental Income | Delayed until handover. | Can be generated immediately. |

| Certainty | Relies on developer reputation. | What you see is what you get. |

Researching High-Potential Communities

Once you’ve picked your lane, zoom in on the location. Don't just chase popular neighbourhoods; find tomorrow's hotspots. Think about areas like Business Bay and Al Jaddaf, which are buzzing with new infrastructure projects that signal future growth.

When researching communities, consider:

- Connectivity: Proximity to major roads, Dubai Metro, and hubs like DWC Airport.

- Amenities: Schools, hospitals, malls, and parks that fit your lifestyle.

- Future Development: New metro lines or attractions are great signs of a neighbourhood on the rise.

A smart investor doesn't just buy a property; they buy into a community's infrastructure, lifestyle, and future potential. That's the secret to finding a place that delivers fantastic financial returns.

Making an Offer and Closing the Deal

You’ve found it. The one. This is where your planning pays off.

Your first move is to make a formal offer through your RERA-certified agent. Once you and the seller agree on terms, you make it official with the Memorandum of Understanding (MOU), also called "Form F." The MOU is a legally binding contract that locks in every detail—price, payment structure, and handover date.

Securing the Agreement

When you sign the MOU, you'll provide a security deposit cheque, typically 10% of the purchase price, held in trust by the agency. This shows the seller you're a committed buyer. The cheque is held as security until the final property transfer is complete.

The Final Transfer at the DLD

The grand finale happens at the Dubai Land Department (DLD). This is the official meeting where ownership is legally transferred to your name.

On transfer day, you, the seller, and your agents will gather. You'll need your final payment ready, typically a manager's cheque.

Several payments are settled:

- The Property Price: The seller receives the final payment.

- DLD Transfer Fee: 4% of the property price, paid to the DLD.

- Trustee Fees: Administrative fees, usually around AED 4,000.

- Agency Commission: Typically 2% for each party.

Once payments clear, the DLD issues a new Title Deed in your name. Congratulations, you are a Dubai property owner! This secure process is why investing in a luxury property in Dubai feels so solid.

Investment Analysis: Maximizing Your Returns

Now, let's make your money work. Finding a high ROI property in Dubai is an achievable goal. The secret is understanding the two key ingredients: rental yields and capital appreciation.

Crunching the Numbers on Your Potential Returns

Rental yield is the cash flow from tenants. To calculate it, divide the total annual rent by the purchase price. An apartment bought for AED 2 million renting for AED 160,000 annually has a gross yield of 8%.

Capital appreciation is the increase in your property's market value over time. Dubai's market has a strong track record, with potential for high capital appreciation of 5-6% per annum.

Your total return is the combination of these two forces. An investor aiming for a high ROI of 10% looks for a property with a solid rental yield of 5-6% plus anticipated capital growth of 4-5% each year.

Sample ROI Showdown: Apartment vs Villa

Let's make this tangible. A luxury apartment in Dubai Marina is a magnet for tourists and professionals, great for high rental demand. On the other hand, a Dubai villa for sale in a community like Dubai Hills Estate is perfect for families, often meaning steadier tenants and strong capital growth.

Here’s a simplified breakdown:

| Metric | Luxury Apartment (Dubai Marina) | 4-Bed Villa (Dubai Hills Estate) |

|---|---|---|

| Est. Purchase Price | AED 2,500,000 | AED 6,000,000 |

| Est. Annual Rent | AED 175,000 | AED 330,000 |

| Gross Rental Yield | 7.0% | 5.5% |

| Est. Annual Appreciation | 4-5% | 5-7% |

| Primary Appeal | High rental demand from professionals. | Strong appeal for families. |

| Investment Focus | Strong immediate cash flow. | Excellent long-term wealth building. |

The 'best' investment fits your financial goals. Are you chasing immediate passive income or playing the long game to build significant wealth?

If you're ready to find a home that fits your life and financial goals, the team at Emerald Estates Properties LLC is here to make it happen. Explore your future home with us today!