A Step-by-Step Guide to the Buying Property in Dubai Process

Thinking of diving into Dubai's dynamic real estate market? It's a fantastic choice. The buying property in dubai process is a well-defined path that has attracted investors globally. With the right knowledge, you can navigate this journey confidently and secure a valuable asset in one of the world's most exciting cities.

This guide breaks down everything you need to know, from initial planning to getting the keys in your hand.

Your Dubai Property Journey Starts Here

Dubai's appeal isn't accidental. It’s built on a foundation of safety, world-class infrastructure, and an incredibly favourable tax environment. For an expat, property laws in the UAE are significantly more welcoming compared to many European or other GCC nations, making it an ideal place to invest and live.

Before you browse listings, understanding two key concepts will streamline your entire approach.

Freehold vs Leasehold Ownership

For any expat buyer, this is the most critical distinction. In designated "freehold" areas—like the iconic Dubai Marina or bustling Downtown Dubai—foreigners can own property outright. This means your name is on the Title Deed, and you have complete control to sell, rent, or inherit the property. It is your asset, period.

Leasehold, on the other hand, gives you the right to a property for a fixed term, often up to 99 years, but you don't own the land itself. For individual investors, freehold is almost always the preferred choice.

Defining Your Investment Goal

Why are you buying? Your answer will dictate your property search, from location to budget.

- Chasing High ROI? If your goal is generating the highest ROI property in Dubai, you might be targeting a high ROI of 10%. A modern Dubai Studio Apartment for sale in a high-demand area like Business Bay could be your perfect cash-flow generator.

- Playing the Long Game? If you're focused on long-term wealth, aiming for a high capital appreciation of 5-6% per annum, a spacious Dubai Villa for Sale in a growing family community like Dubai Hills Estate is a brilliant strategy.

- Living the Dream? Perhaps it's all about lifestyle. You might be searching for luxury properties in Dubai to enjoy everything the city offers. A stunning townhouse in Jumeirah Golf Estates would be a perfect fit.

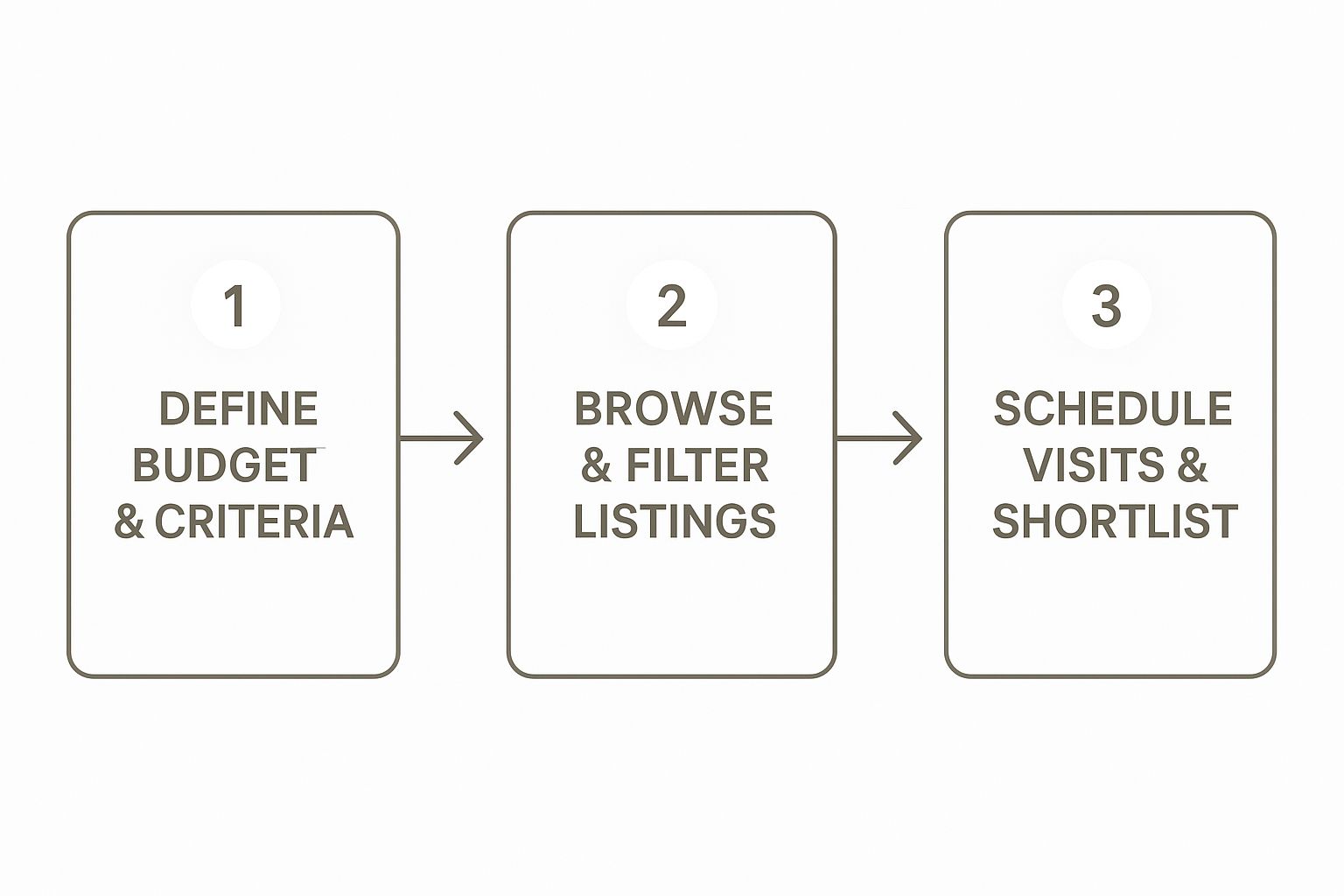

The property journey is a clear process. Here’s a quick overview of the key stages.

Key Stages of Buying Property in Dubai

| Stage | Key Action | Primary Consideration |

|---|---|---|

| 1. Preparation & Finance | Secure mortgage pre-approval or confirm cash funds. | Your budget and purchasing power. |

| 2. Property Search | Identify your ideal property type and location with an agent. | Matching your goals (ROI vs. lifestyle). |

| 3. Making an Offer | Submit a formal offer via a Memorandum of Understanding (MOU). | Negotiation and securing the deal with a 10% deposit. |

| 4. Legal Formalities | Obtain a No Objection Certificate (NOC) from the developer. | Ensuring the property is free of outstanding dues. |

| 5. Transfer of Ownership | Visit the Dubai Land Department (DLD) to complete the transfer. | Paying DLD fees (4% of property value) to receive the Title Deed. |

| 6. Handover | Receive the keys and connect utilities. | Your official move-in day! |

This table maps your path from start to finish. Knowing what's next is half the battle. You can find more details in this property purchasing in Dubai for 2025 guide.

A clear goal is your compass. It keeps you focused on what truly matters for your financial future and stops you from getting sidetracked by properties that don't fit your plan.

Mastering Your Finances for a Dubai Property

Before you start decorating that beautiful Dubai Villa for Sale in your mind, let’s talk money. Getting your finances in order is the foundation of a successful purchase.

You can either be a cash buyer or use a mortgage. In Dubai, cash is king. It simplifies the buying property in dubai process, eliminates bank approvals, and often gives you a stronger negotiating position. However, a mortgage allows you to leverage your capital for a more valuable property. For non-residents, banks often require a down payment of up to 50%, making cash a popular option.

Decoding the True Cost of Your Investment

The list price is just the beginning. A solid budget must include all associated fees to avoid surprises.

- Dubai Land Department (DLD) Fees: 4% of the purchase price, plus admin fees. This is the government charge to register your ownership.

- Real Estate Agency Commission: Typically 2% of the property price, plus 5% VAT on the commission amount.

- Mortgage Registration Fees: If using a mortgage, the DLD charges 0.25% of the loan amount.

- No Objection Certificate (NOC) Fee: For resale properties, the developer charges between AED 500 to AED 5,000 for this certificate.

Knowing these numbers is crucial. For example, on a property worth AED 2 million, you should budget for at least AED 135,000 in transaction costs. This foresight is what separates a smooth transaction from a stressful one.

Finding Your Perfect Dubai Property Investment

With finances sorted, the exciting hunt begins! You can buy off-plan (directly from a developer before construction is complete) or from the secondary market (a ready property from an existing owner).

- Off-Plan: Offers attractive payment plans and high potential for capital appreciation. It’s ideal for investors looking for growth.

- Secondary Market: What you see is what you get. It’s perfect for those who want to move in or start earning rental income immediately.

Matching Your Goal to the Right Community

Dubai is a city of diverse communities. Your investment goal should guide your location choice.

For long-term growth and a family lifestyle, a Dubai Villa for Sale in Dubai Hills Estate offers green spaces and top-tier amenities, promoting steady capital appreciation. For maximum rental income, a chic Dubai Studio Apartment for sale in a high-energy hub like Dubai Marina is a prime choice, attracting professionals and tourists year-round. Recent Dubai real estate market trends and reports confirm that areas like JVC, Dubai Marina, and Business Bay offer excellent rental returns.

You Need a Great Agent in Your Corner

Navigating this market alone is not advisable. A RERA-certified real estate agent is your strategic partner. They provide insider knowledge, curate properties based on your goals, and are master negotiators who can secure the best price and terms for you.

Your agent is your champion. Their experience is the difference between an emotional choice and a smart, data-driven investment.

Navigating the Legal Path to Ownership

You've found the perfect property. Now it’s time to make it legally yours. The process is secure and transparent.

- Memorandum of Understanding (MOU): Also known as Form F, this is the formal agreement that outlines the price and terms. You will provide a 10% security deposit, held by the agency, to take the property off the market.

- No Objection Certificate (NOC): For secondary market properties, this document from the developer confirms the seller has no outstanding service charges. This is your guarantee that you won't inherit any debts.

- Final Transfer at the DLD: The final step happens at a Dubai Land Department (DLD) Trustee Office. Here, you, the seller, and agents meet to sign the final documents and transfer the funds. You’ll pay the remaining balance and the 4% DLD transfer fee.

Once processed, the DLD issues a new Title Deed in your name. Congratulations, you are officially a property owner in Dubai! This is the moment your investment in a Dubai Villa for Sale becomes a reality.

From Handover to Homeowner

You're at the finish line of the buying property in Dubai process. The handover begins with a final inspection, called "snagging." This is your chance to meticulously check the property for any defects, from paint finishes to plumbing. You'll create a "snagging list" for the developer to fix before you officially accept the property.

Once you are satisfied and sign the handover papers, you receive the keys. Your next steps are to connect your utilities with the Dubai Electricity and Water Authority (DEWA) and, if renting out, register the tenancy contract with Ejari.

Owning property here unlocks incredible benefits. A property valued over AED 2 million makes you eligible for a 10-year Golden Visa, offering long-term residency for you and your family. This complements the financial rewards with Dubai's unparalleled safety and lifestyle.

Your Dubai Property Questions Answered

Diving into a new market naturally brings questions. Here are clear answers to some of the most common ones.

Can Foreigners Buy Freehold Property Anywhere in Dubai?

Yes, but only within designated "freehold" areas. The government created these zones specifically for international investors. This is why communities like Dubai Marina, Downtown Dubai, and Dubai Hills Estate are so popular with expats. In these zones, you get 100% ownership, with your name registered on the Title Deed at the Dubai Land Department.

What UAE Laws Favour Expat Property Buyers?

Dubai’s legal framework is designed to attract global investors. The impact of taxes in property investment is minimal, which is a significant advantage. Key laws favouring expats include:

- Property Investor Visas: Your property can be your path to residency. An investment over AED 2 million can qualify you for a 10-year Golden Visa.

- No Annual Property Taxes: Unlike in many Western countries, there are no annual property taxes on residential properties, which boosts your net returns.

- Zero Capital Gains Tax: When you sell your property and realize a high capital appreciation of 5-6% per annum, that profit is 100% yours to keep.

What Ongoing Costs Should I Expect After Buying?

Beyond the purchase price, you should budget for recurring costs to accurately calculate your ROI.

- Annual Service Charges: These fees cover the maintenance of common areas like pools, gyms, and security. They vary depending on the community and amenities.

- DEWA: Your monthly electricity and water bills.

- Home Insurance: Highly recommended to protect your asset.

Factoring in these costs is a key part of the buying property in Dubai process and ensures you have a clear picture of your investment's profitability.

Ready to turn these answers into action and find your perfect Dubai property? The expert team at Emerald Estates Properties LLC is here to guide you through every step of the journey, from identifying the highest ROI opportunities to navigating the legal process with ease. Discover how we can help you achieve your real estate goals by visiting us at https://emeraldestates.ae.