Mortgage Interest Rates Dubai: Your Ultimate Guide

Thinking about jumping into Dubai's electrifying property market? Fantastic choice. Getting to grips with mortgage interest rates is the most powerful first step you can take. Whether you're dreaming of a sprawling villa or a high-return city apartment, this guide cuts through the noise to give you the real deal on the financial side of your investment.

Your First Step to Smart Dubai Property Investment

Let's be honest, diving into property finance can feel like a lot. But it's also your ticket to some incredible opportunities, especially for expats. Dubai isn't just another city; it's a global hotspot for property investors. We're talking about a unique blend of high returns, solid security, and a legal system that rolls out the red carpet for investors. The UAE laws which favor expats buying property are a significant draw, offering a level of security and straightforwardness that’s often hard to find in other GCC and European countries. In this environment, a mortgage isn't just a loan—it's a strategic tool.

First things first, you need a feel for the current financial climate. Heading into early 2025, the mortgage scene in Dubai is pretty competitive. On average, you'd see fixed mortgage rates sitting somewhere between 3.90% and 4.75%. Variable rates? They had more wiggle room, stretching from 5.50% all the way up to 8.00%. Big-name lenders like First Abu Dhabi Bank were putting some very attractive introductory fixed rates on the table, often between 3.99% and 4.44%. You can dig into more UAE property price trends to see the bigger picture.

Why You Should Be Obsessed With Mortgage Rates

Nailing a great interest rate is about so much more than a lower monthly payment. It has a massive impact on your overall profit. Think about it: a lower rate means you pay significantly less over the life of the loan.

For any serious investor, this is where the magic happens. A well-structured mortgage can be the deciding factor in hitting those impressive returns you're after, like:

- A high ROI of 10%: Every dirham you save on financing costs boosts your net rental income.

- High capital appreciation of 5-6% per annum: A mortgage that doesn't strain your finances allows you to hold your property and ride the wave of value appreciation.

The impact of taxes in property investment here is minimal. The UAE's pro-investor stance includes no property taxes, which is a huge draw for buyers worldwide. Whether your heart is set on a Dubai villa for sale in a gorgeous community like Dubai Hills Estate or a sleek apartment in Downtown Dubai, your journey starts here. By understanding mortgage interest rates, you're giving yourself the power to make smart, confident decisions.

Fixed vs. Variable Rates: Choosing Your Path

Alright, let's get into one of the biggest decisions you'll make when buying property in Dubai: choosing between a fixed and a variable rate mortgage. This choice directly impacts your monthly payments and how much you'll pay over the long haul.

Think of a fixed-rate mortgage as setting your financial autopilot. For a set period, usually between one and five years, your interest rate is completely locked in. No matter what the economy does, your monthly payment stays exactly the same. For anyone who loves predictability, this is a massive win.

On the other hand, you have the variable-rate mortgage. This is more like sailing with the economic winds. Your rate is linked directly to the Emirates Interbank Offered Rate (EIBOR), meaning it can go up or down. If market rates fall, you're in luck—your payments could get cheaper. But if they climb, so will your monthly bill.

The Anchor of Stability: Fixed Rates

A fixed-rate mortgage is the ultimate security blanket for homebuyers. It's the go-to for anyone who prioritises peace of mind. Knowing precisely what you owe each month makes financial planning an absolute breeze.

The main benefits are crystal clear:

- Budgeting Certainty: Your payments are set in stone for the fixed term.

- Simplicity: It’s incredibly straightforward. You know the deal from day one.

- Financial Security: It acts as a shield against inflation and rising interest rates.

The catch? This stability often comes at the price of a slightly higher initial interest rate. Plus, if market rates take a nosedive, you won't get to enjoy those savings until your fixed term is over.

Riding the Market Waves: Variable Rates

Now, a variable rate can be a brilliant strategic move, especially for savvy investors. If you've got a feeling that interest rates are on a downward trend, this option could save you a serious amount of cash over time.

Here’s why it’s so appealing to some:

- Potential for Lower Payments: If the EIBOR drops, your mortgage costs follow suit.

- Lower Introductory Rates: Banks often dangle more attractive initial rates on their variable products.

- Flexibility: Many variable loans are more lenient when it comes to making overpayments without hefty penalties.

The risk, of course, is the flip side: rates could rise, and your monthly payments will increase right along with them. This unpredictability means you need a financial buffer to handle any potential hikes.

Fixed vs Variable Mortgages in Dubai at a Glance

| Feature | Fixed Rate Mortgage | Variable Rate Mortgage |

|---|---|---|

| Payment Stability | Payments are constant for the fixed term (1-5 years). | Payments can change (monthly or quarterly) based on EIBOR. |

| Risk Level | Low. You're protected from rate increases. | Higher. You're exposed to market fluctuations. |

| Initial Rate | Often slightly higher than a variable rate. | Typically starts lower, making it attractive initially. |

| Best For | First-time buyers, budget-conscious individuals, those seeking predictability. | Experienced investors, buyers with high-risk tolerance, those expecting rates to fall. |

| Potential Downside | You miss out if market rates drop significantly. | Your payments could increase, straining your budget. |

Ultimately, choosing between fixed and variable isn't about which one is "better" in a general sense, but which one is better for you. It all comes down to your personal financial situation and your comfort level with risk.

As you can see, having a stronger credit profile and putting down a larger deposit will almost always get you a more favourable interest rate. Whether you’re eyeing a stunning Dubai studio apartment for sale in the heart of Business Bay or a sprawling family villa, getting this choice right is paramount. Take your time and chat with the experts from a trusted partner like Emerald Estates Properties LLC to find the path that sets you up for success.

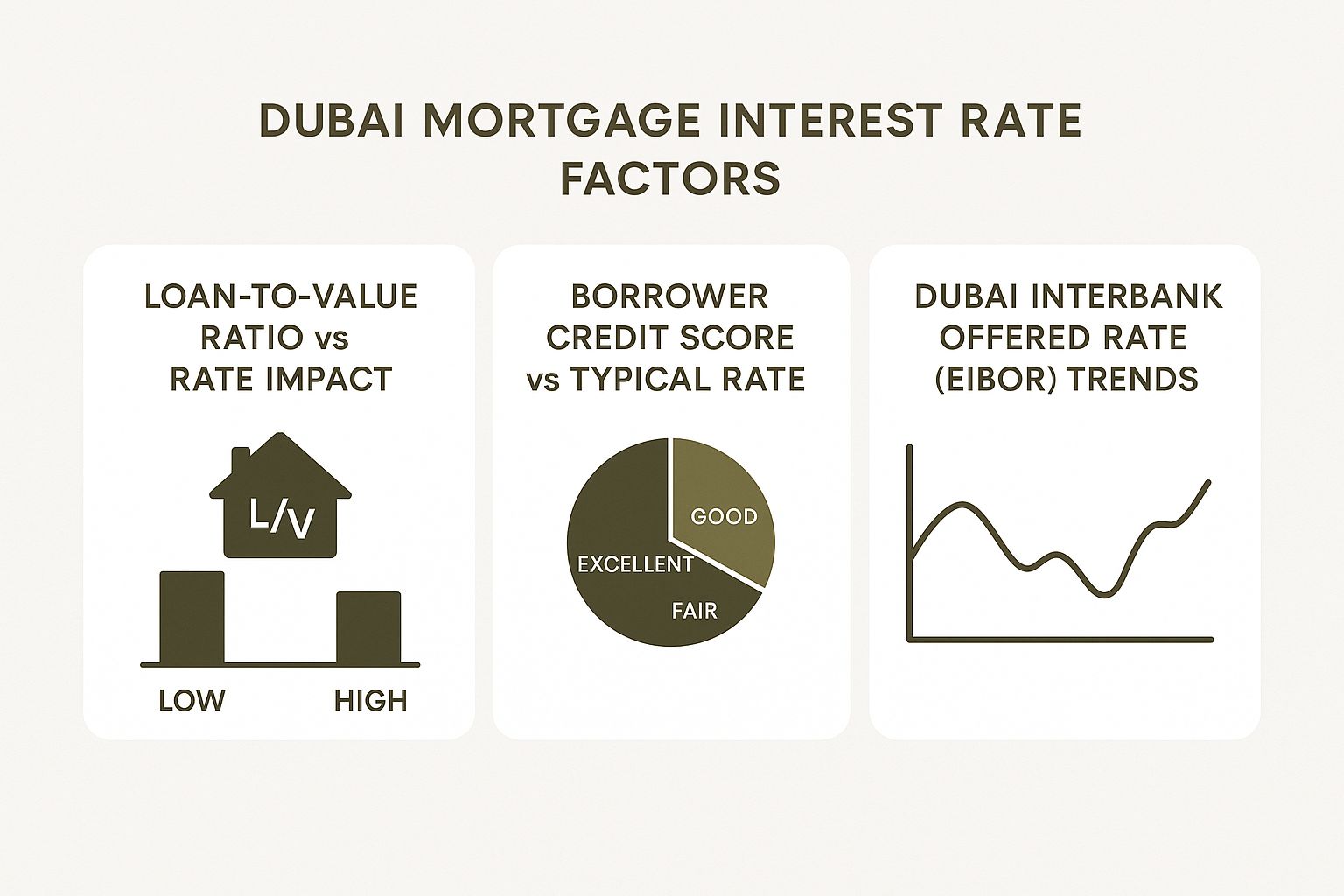

The Forces That Shape Dubai Mortgage Rates

Ever wondered who’s really pulling the levers behind the mortgage interest rates you see advertised? It’s the result of powerful economic forces all working together, and getting a handle on them gives you a massive advantage when you’re looking to invest. It helps you anticipate shifts in the market and time your property purchase perfectly.

Think of it like this: the UAE Central Bank is the captain of the economic ship. Its decisions on policy rates send ripples across the entire financial system. Then you have the Emirates Interbank Offered Rate (EIBOR), which is like the daily ocean current that directly nudges your bank's variable mortgage rates up or down.

The Central Bank and EIBOR: The Key Players

The Central Bank's main job is to keep the economy stable. When it decides to adjust its main policy rate, it’s basically changing the cost of borrowing for every commercial bank in the UAE.

EIBOR, on the other hand, is the rate at which banks lend money to each other. It’s a crucial benchmark that changes daily and forms the foundation for nearly all variable-rate mortgages in Dubai. When EIBOR goes up, so do variable mortgage payments.

Understanding the dance between the Central Bank's policy and the daily EIBOR is everything. A change in the policy rate almost always triggers a similar shift in EIBOR, directly influencing the mortgage interest rates Dubai lenders can offer.

UAE short-term interest rates have certainly been on a rollercoaster. For instance, the 3-month EIBOR was sitting at 4.20% per annum in February 2025. This same rate hit an all-time high of 5.60% in late 2023 and a record low of just 0.33% back in March 2021. You can dig into more of this data on UAE short-term interest rates to see these trends.

Broader Economic Influences on Your Rate

Beyond these two big players, several other global and local factors are stirring the pot, affecting the rates you'll be offered for that dream Dubai Villa for Sale.

- Global Inflation: When major economies like the US raise their interest rates to fight inflation, the UAE usually follows suit. This is because the Dirham is pegged to the US Dollar.

- Oil Prices: As a major oil producer, the UAE's economy is tied to what's happening with oil prices. Higher prices can boost economic confidence, sometimes leading to more stable rates.

- Local Property Demand: A hot real estate market—and Dubai’s is certainly sizzling—cranks up the demand for mortgages. When demand is high, banks often compete for your business by offering more attractive rates.

By keeping an eye on these key drivers, you stop being a passive buyer and become a strategic investor. This knowledge helps you predict rate movements, letting you decide the absolute best time to lock in your financing.

Nailing the Best Mortgage Deal in Dubai

Alright, let's get down to turning your dream of owning a home in Dubai into a reality. Landing the right mortgage is a game-changer, and with a smart strategy, you can walk into any bank with confidence. This is your playbook.

Think of it like this: you're pitching your biggest project yet—your new home—and the banks are the investors. Your job is to present a solid, compelling case.

Get Your Financial Toolkit in Order

Before you even think about stepping into a bank, you need to get your financial life looking sharp. Lenders are all about minimising their risk.

Start by pulling together all the key documents. You’ll need:

- Proof of Income: Your latest salary certificate, pay slips from the past six months, and your employment contract.

- Bank Statements: Have at least six months of personal bank statements ready.

- ID Documents: Clear copies of your passport, residence visa, and Emirates ID.

- Credit Report: Pull your report from the Al Etihad Credit Bureau (AECB). A score of 700 or above is your golden ticket.

Having this ready from day one shows you mean business and makes the whole process smoother.

Buff That Credit Profile Until It Shines

Your credit score isn't just a number; it's your most powerful negotiation tool. A high score tells a bank you're a low-risk borrower, which is your direct line to securing the best mortgage interest rates in Dubai. If your score could be better, now's the time to work on it. Chip away at any existing debts and make every single payment on time.

Your credit history is your best friend in this process. It proves you're reliable, which gives you incredible leverage to negotiate a lower interest rate on that amazing Dubai Townhouse for Sale you've been eyeing.

Don't Be Afraid to Haggle

Once you get that pre-approval, the game isn't over. The first offer a bank slides across the table is almost never their best one. This is your moment to negotiate.

Walk into that conversation armed with facts. Your stellar credit score, stable job, and healthy down payment are your bargaining chips. Don't be shy about mentioning better offers you've received from other banks. And remember, it's not just about the interest rate. Push back on processing fees and valuation charges, too.

An Expat’s Edge: How UAE Laws Work for You

Dubai didn't become a global property hotspot by accident. The entire system is built to attract international investment. As an expat, you're exactly the kind of buyer the market wants.

This pro-investor mindset means that banks here actively compete for your business. The process is far more straightforward than in many other countries where buying as a foreigner can be a bureaucratic nightmare. This competition gives you, the buyer, a huge advantage. It's a key piece of information in any good expat property guide and a major reason why investing here is so attractive.

What’s on the Horizon for Dubai Mortgage Rates?

So, what does the future hold for anyone borrowing money for a home in Dubai? Peering into the crystal ball of real estate finance is about dissecting current trends and learning from the past. If you’re eyeing up one of the stunning luxury properties in Dubai, timing is everything. Getting a handle on where mortgage interest rates Dubai might be heading is your secret weapon.

The story of interest rates here in the UAE has always been one of constant motion. Looking back, the long-term benchmark interest rate averaged 1.94% from 2007 to 2025. But then, it shot up to a hefty 5.40% in July 2023. This history shows how quickly the ground can shift. You can dive into the full history of historical UAE interest rates to see the rollercoaster for yourself.

What the Experts Are Predicting

Alright, so where are we heading? Most economists seem to be singing from the same hymn sheet: a period of slow and steady calming. After a whirlwind of rate hikes, the conversation is now turning to stability and, eventually, a bit of relief.

While the base rate was sitting at 4.40% at the end of 2024, the general feeling is that it will begin a gradual slide downwards. Some forecasts are pointing to a potential drop to around 3.40% by 2026. This is the kind of trend that should make any borrower's ears perk up.

This potential for rates to drop is incredible news for investors chasing that sweet spot of 5-6% per annum in capital appreciation. Lower interest rates mean your borrowing costs go down, which pumps up your overall profit.

How to Time Your Dubai Property Purchase

With all this in mind, the million-dirham question is: when do you pull the trigger?

Let's break down the strategy.

- Move Now, Win Now: Found your dream Dubai villa for sale in a top-tier community like Jumeirah Golf Estates? Locking in a mortgage right now could be a genius move. You could grab a shorter-term fixed rate to secure the property before its price climbs even higher, giving you the flexibility to refinance later when rates fall.

- Wait and See: If you're not in a rush, a little patience could pay off handsomely. Waiting might let you catch the wave of those projected rate cuts, setting you up with a much better long-term deal.

At the end of the day, there's no single right answer. It all comes down to your personal finances and how much risk you're comfortable with. The real key is to keep your finger on the pulse and stay nimble. By keeping an eye on the economic news and teaming up with a real estate pro you trust, like our team at Emerald Estates Properties LLC, you'll be perfectly positioned to make a winning move.

Why Dubai Is a Premier Real-Estate Investment Hub

Getting a great deal on mortgage interest rates in Dubai is a fantastic start, but the city's magnetic pull for investors goes way deeper. It's the powerful blend of an incredible lifestyle and rock-solid financial perks that makes Dubai a true standout. You're not just buying bricks and mortar; you're buying into a visionary city built for success.

First off, Dubai's reputation for safety is legendary. This creates a tangible sense of stability that underpins the entire property market. People feel safe, businesses are confident, and property values are well-protected. Add to that the world-class infrastructure—from an efficient transport system to hyper-fast digital connectivity—and you have a city that operates as brilliantly as it looks.

A Tax-Friendly Haven for Investors

Now, let's talk about the real game-changer: the tax environment. This is where Dubai truly shines.

In Dubai, you'll find no annual property taxes, no income tax on your rental earnings, and zero capital gains tax when it's time to sell. This pro-investment approach means more of your hard-earned money stays exactly where it should be—in your pocket.

This massive advantage is what makes achieving a high ROI of 10% and consistent capital appreciation of 5-6% per year a realistic goal. Every dirham you don't pay in taxes directly boosts your bottom line.

Laws Designed for Global Citizens

The UAE government has gone out of its way to make property ownership a smooth and secure process for expats. Forget the bureaucratic nightmares you might find elsewhere; Dubai's legal framework is designed to be clear and protective. This is a must-know feature in any good expat property guide.

This forward-thinking legislation gives you a secure foundation for your investment, whether you’re eyeing one of the stunning luxury properties in Dubai or a comfortable family home. The government’s dedication to transparency is a key reason why so many people have confidently chosen to buy here.

When you put it all together—a secure lifestyle, amazing infrastructure, and incredibly favourable financial laws—Dubai is far more than just a place to live. It's a strategic move into a city that consistently delivers both outstanding returns and an unbeatable quality of life.

Ready to explore your options? Get in touch with the experts at Emerald Estates Properties LLC and let's find your perfect property today.

Your Top Mortgage Questions Answered

Diving into the Dubai property market is exciting, but it's natural to have a few questions. Let's tackle some of the most common queries we hear from buyers.

Can Expats Get a Mortgage in Dubai?

Absolutely! The UAE has gone to great lengths to create expat-friendly laws to welcome global investment. Banks here are well-versed in helping foreign nationals secure financing. As an expat, you'll generally need a down payment of around 20-25% of the property's value. You'll also need to prove you have a steady income.

What Is the Standard Mortgage Term?

Most mortgages in the UAE are set for a 25-year term. However, your age is a key factor. Banks typically require the loan to be fully paid off by the time you reach 65 (if salaried) or 70 (if self-employed). So, if you're applying later in life, you might be offered a shorter loan term.

How Does My Salary Affect the Loan Amount?

This is a big one. Under UAE Central Bank rules, all your monthly debt repayments—your new mortgage, plus any other loans or credit card bills—can't exceed 50% of your total monthly income. This calculation is called the Debt-to-Burden Ratio (DBR). A higher salary with fewer existing debts means you can qualify for a much larger mortgage, opening up your options when searching for that perfect Dubai property for sale.

Think of the DBR as a financial health check. Banks use it to make sure you won't be overstretched by your new mortgage, which protects both you and them.

Are There Extra Fees Involved?

Yes, and it's so important to budget for them! When you take out a mortgage in Dubai, you'll need to account for a few other costs.

Here’s a quick rundown of what to expect:

- Bank Processing Fee: This is usually around 1% of the loan amount.

- Property Valuation Fee: The bank needs to have the property professionally valued.

- Insurance Fees: You'll be required to get both property and life insurance.

Remember, these are separate from your other buying costs, like property registration fees. Factoring them in from the beginning will save you any surprises.

Getting your head around mortgage interest rates in Dubai is the first major step to making a smart investment. Here at Emerald Estates Properties LLC, our team lives and breathes this stuff. We're here to guide you through every stage and make sure you lock in the very best terms for your new property.

Explore your Dubai property opportunities with Emerald Estates Properties LLC today!