Buying Property in Dubai as a Foreigner: An Expat Property Guide

Buying property in Dubai as a foreigner isn't just possible—it's surprisingly straightforward, and that’s by design. Back in 2002, visionary laws opened the doors for global investors, allowing expats and non-residents to buy freehold properties in designated areas with 100% ownership. This single move turned Dubai into the secure, high-return investment hub it is today.

This guide will cut through the noise and show you exactly why Dubai is a magnet for real estate investors worldwide. We'll explore the financial benefits, the best locations, and the simple steps to owning your piece of this dynamic city.

Why Dubai is a Top Choice for Foreign Investors

The city's property scene isn't just doing well; it's electric, with a market firing on all cylinders. But what’s Dubai's secret sauce? It's a unique blend of incredible lifestyle, rock-solid economic stability, and policies that genuinely favour investors. The UAE government has been meticulous in creating an environment that not only protects foreign investments but also sweetens the deal with fantastic financial perks.

This means that buying a stunning Dubai Villa for Sale in a lush community like Jumeirah Golf Estates, or a sleek apartment in Business Bay, is a savvy move to build long-term wealth.

Here’s a quick rundown of what makes investors flock here:

- Impact of Taxes: This is a big one. You pay zero annual property taxes and zero income tax on rental earnings. That cash goes straight into your pocket, dramatically boosting your net returns compared to markets in Europe or even neighbouring GCC countries.

- Serious Returns on Investment: The numbers speak for themselves. Investors often enjoy a high ROI of up to 10% on rental income, plus strong capital appreciation of 5-6% per annum in the most sought-after locations.

- The Golden Visa: Investing AED 2 million or more in property can be your ticket to a 10-year residency visa, offering stability for you and your family.

The powerful combination of a booming economy, world-class infrastructure, and UAE laws designed for expat ownership makes this environment incredibly secure. You're not just buying a property; you're investing in a future backed by one of the most dynamic cities on the planet.

Finding Your Perfect Investment Location in Dubai

Now, let's get to the exciting part: deciding where in Dubai you want to buy. The first thing to understand is "freehold" ownership. In designated freehold zones, a foreigner can own property with 100% ownership rights—the building, the land, everything. It’s yours, outright and forever.

Dubai’s freehold zones are an incredible mix, from electric urban hubs to quiet, family-friendly suburbs. The best fit for you really boils down to your personal goals.

Mapping Out Dubai's Freehold Hotspots

Are you looking for a high-energy, cosmopolitan lifestyle with strong rental returns?

- Dubai Marina: A powerhouse for rental demand from young professionals and tourists. Picture high-rise apartments overlooking a marina filled with yachts.

- Downtown Dubai: The beating heart of modern Dubai, home to the Burj Khalifa. It’s the ultimate address for luxury and a prime target for strong, long-term capital appreciation.

If your vision is less city buzz and more green space, you're in luck. Dubai Hills Estate offers a gorgeous blend of luxury villas and townhouses wrapped around a championship golf course, perfect for families. Finding a Dubai Townhouse for Sale here isn't just buying a home; it's investing in a lifestyle. For a deep dive into regulations, check out this guide on foreign ownership laws in the UAE.

Comparing Top Dubai Communities for Foreign Buyers

This table breaks down some popular freehold communities to help you zero in on the right fit.

| Community | Popular Property Types | Average Rental ROI | Best For |

|---|---|---|---|

| Dubai Marina | Apartments, Penthouses | 6-8% | Young Professionals, High Rental Yields |

| Downtown Dubai | Luxury Apartments | 5-7% | High-End Lifestyle, Capital Appreciation |

| Dubai Hills Estate | Villas, Townhouses | 4-6% | Families, Luxury & Green Living |

| Business Bay | Apartments, Commercial | 7-10% | Investors Seeking High ROI, Professionals |

| Al Jaddaf | Apartments | 6-8% | Savvy Investors, Future Growth Potential |

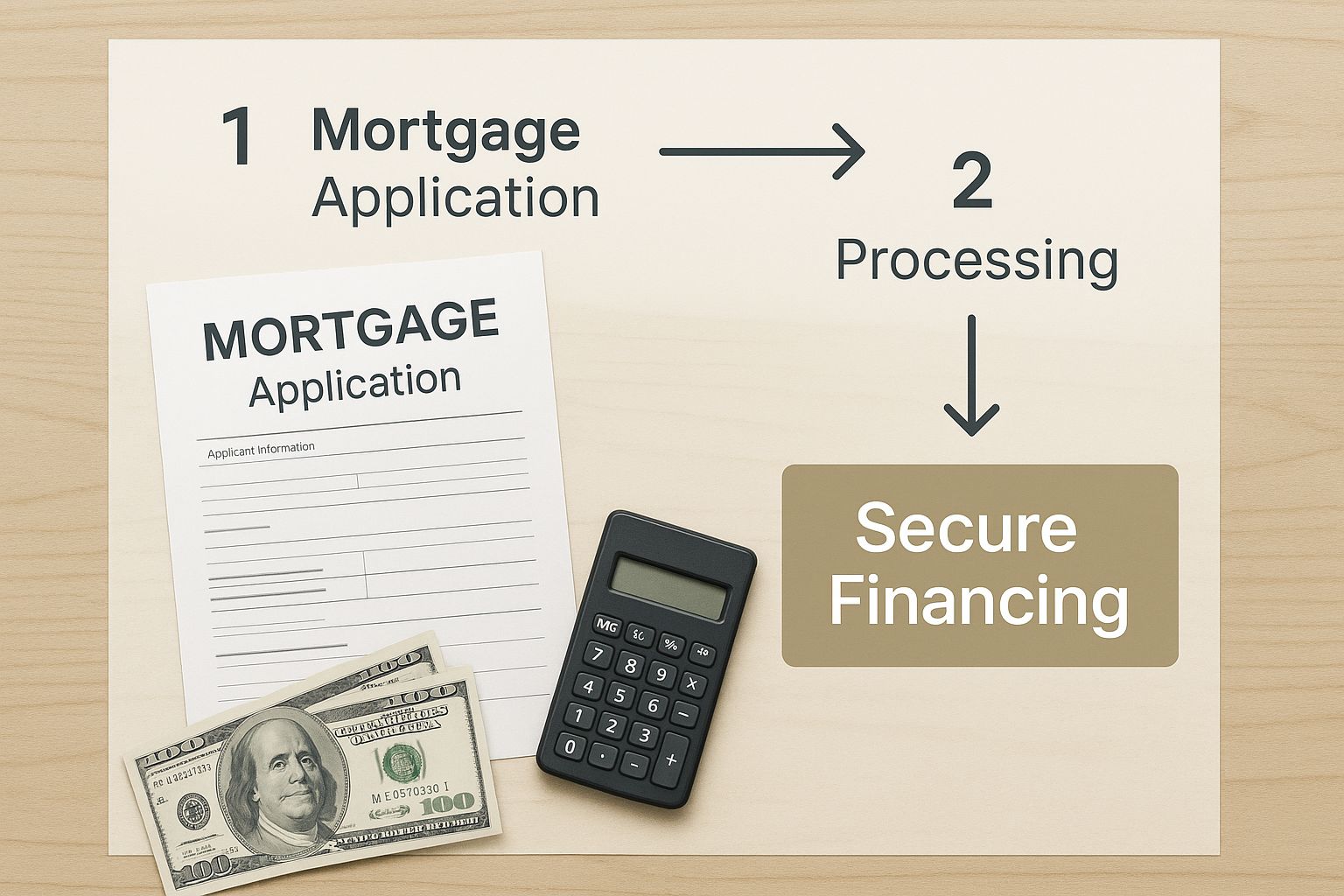

From Offer to Keys: The Dubai Property Purchase Process

The path from making an offer to getting the keys is clear and transparent. Your first move should be to partner with a RERA-certified real estate agent. They are your guide and advocate, ensuring everything is handled professionally.

Here’s how the process typically unfolds:

- Memorandum of Understanding (MOU): You formalise your offer with an MOU (or Form F), a legally binding contract detailing the price and terms. At this stage, you'll pay a 10% security deposit, held securely in escrow.

- No Objection Certificate (NOC): The property developer issues this document, confirming they approve the sale and that the seller has settled all outstanding fees. This is mandatory for the transfer.

- Transfer at DLD: The final step happens at a Dubai Land Department (DLD) trustee office. Here, you'll pay the remaining balance and associated fees. The main costs are the 4% DLD Transfer Fee and a 2% agent commission.

- Title Deed: Once payments are cleared, the DLD issues a new Title Deed in your name. Congratulations, you are officially a Dubai property owner!

Crunching the Numbers: Your High ROI Potential

Let's talk numbers. Dubai is famous for delivering impressive returns. With the right strategy, you can realistically aim for a high ROI of 10% or more. The trick is to focus on areas with relentless rental demand.

For example, a Dubai Studio Apartment for Sale in a powerhouse location like Business Bay can be a rental goldmine. It's a magnet for professionals, keeping occupancy rates high. It’s this dynamic that can push your net rental yield into that coveted double-digit range.

One of the most powerful advantages, especially when compared to European countries, is that UAE laws feature zero capital gains tax. When you sell your property after it has appreciated, you keep 100% of the profit.

Rental income is only half the story. The real secret to building wealth is capital appreciation. In Dubai's top communities, we consistently see a high capital appreciation of 5-6% per annum, solidifying your financial future.

Dubai's property market is a vibrant, global crossroads. Investors from India, the UK, and China consistently rank among the top buyers of luxury properties in Dubai. This diverse interest is the bedrock of the market's stability and resilience. You can see more data on Dubai's top foreign investor nationalities. This global stamp of approval ensures continuous demand, making it easier to rent or sell your property when the time is right.

At Emerald Estates Properties LLC, we live and breathe this stuff. Our passion is helping international investors like you navigate every single step of this exciting journey. From pinpointing the perfect high-yield property to making the paperwork feel effortless, our team is here to turn your Dubai real estate goals into a reality.

Ready to see what’s possible? Explore your opportunities with us at https://emeraldestates.ae.