Buying Property in Dubai for Foreigners: Your Complete Guide

You might be thinking, "Can I, as a foreigner, actually buy property in Dubai?" The answer is a resounding yes. In fact, Dubai has rolled out the red carpet for international investors, making the process not just possible, but incredibly straightforward and rewarding. The government has carved out specific freehold zones where foreigners can own property outright, opening up a direct path to residency and offering financial perks you’d be hard-pressed to find anywhere else.

Why Dubai Is a Global Magnet for Property Investors

It’s no fluke that Dubai has become a top-tier destination for property investors from around the globe. The city has masterfully blended a booming, forward-thinking economy with policies that genuinely put investors first. For anyone looking into buying property in Dubai for foreigners, the appeal is so much more than just the iconic skyline.

The financial advantages are immediate and massive. One of the biggest draws? The tax situation. Imagine collecting rental income or selling a property for a hefty profit and getting to keep every single dirham. Dubai makes this happen with zero income tax on rental yields and zero capital gains tax when you sell. This isn't just a small benefit; it directly pumps up your net return, leaving similar investments in Europe or North America in the dust. The impact of taxes in property investment is minimal here, which is a major draw for expats.

Unpacking the Financial Powerhouse

The sheer numbers driving Dubai's property market tell a powerful story of strength and incredible demand. This isn't just a stable market; it’s a market experiencing explosive, record-breaking growth.

Just look at the recent figures from the Dubai Land Department (DLD). In the first half of this year alone, the market blew past all previous records, clocking in over AED 431 billion (that's about $117 billion!) in real estate deals. That’s a jaw-dropping 25% jump in value from the same time last year. You can dive into the details of this incredible performance in this Times of India report on Dubai's H1 real estate deals.

What truly makes Dubai a unicorn in the property world is its unique ability to offer both rock-solid security and exceptional returns. You're not just buying a piece of real estate; you're buying into a secure, pro-business ecosystem built for long-term prosperity.

This incredible economic momentum is backed by smart government initiatives, making it a genuine safe haven for your capital. The city's unwavering focus on safety and quality of life continues to attract a diverse global crowd, which means consistently high demand for rental properties.

Targeting High Returns and Growth

For any smart investor, it boils down to two things: steady cash flow and watching your asset grow in value. Dubai knocks it out of the park on both fronts.

- High ROI of up to 10%: We’re talking about rental yields that consistently outperform other major cities. Whether it’s a chic "Dubai Studio Apartment for sale" in the heart of Business Bay or a family-friendly "Dubai Townhouse for Sale" in a community like Dubai Hills Estate, the returns are seriously impressive.

- High Capital Appreciation of 5-6% Per Annum: With a constant stream of new residents and businesses, property values are on a steady upward trajectory. This is how you build real, tangible wealth over time.

- Expat-Friendly Laws: The UAE has laws designed to favour expat buyers. Unlike many other GCC and European countries, you can secure long-term residency visas based on your property investment, adding an incredible layer of personal security and benefit to the deal.

At the end of the day, investing in "Luxury properties in Dubai" is more than just a financial play. It's a strategic entry into a market that's been engineered for success, offering a one-of-a-kind mix of lifestyle perks and powerful financial incentives.

Navigating Dubai’s Freehold and Leasehold Zones

Let’s get down to the most important first step: understanding where you can actually buy property. Dubai’s market for foreign buyers is split into two main categories: freehold and leasehold.

For virtually every international investor, freehold is the way to go. It means you own the property—and the land it sits on—outright. Forever. You can sell it, rent it out, or leave it to your kids. This ownership model truly opened Dubai to the world.

Then you have leasehold, which gives you the right to a property for a very long time, usually up to 99 years, but you don't own the land itself. For total control and the best shot at long-term capital growth, freehold is the clear winner.

Where to Find Dubai’s Prime Freehold Communities

The government has designated specific, high-potential areas as freehold zones. These are some of the most iconic and desirable neighbourhoods in the city. This strategic approach is what makes buying property in Dubai for foreigners such a smooth process. You can get a deeper understanding of how these foreign ownership laws in the UAE have created such a secure and inviting market.

The real beauty of Dubai’s freehold system is its absolute clarity. It cuts through the confusion you might find elsewhere, giving you 100% ownership and the confidence that comes with it. Your name is on that title deed, registered with the Dubai Land Department. It's yours.

Choosing the right neighbourhood isn't just about picking a nice spot—it’s about aligning your lifestyle goals with your financial strategy.

Top Freehold Communities for Foreign Buyers

| Community | Best For | Common Property Types | Average Price Point |

|---|---|---|---|

| Dubai Marina | Young professionals, tourists, vibrant living | Apartments, Penthouses | Mid to High |

| Downtown Dubai | Urban luxury, iconic landmark proximity | Apartments, Branded Residences | High to Ultra-High |

| Dubai Hills Estate | Families, luxury & green living | Villas, Townhouses, Mansions, Apartments | Mid to High |

| Arabian Ranches | Established family communities, suburban feel | Villas, Townhouses | Mid-Range |

| Palm Jumeirah | Unmatched prestige, beachfront lifestyle | Villas, Apartments, Penthouses, Townhouses | High to Ultra-High |

| Jumeirah Golf Estates | Golf enthusiasts, exclusive & serene living | Villas, Townhouses, Mansions | High |

Each of these areas offers a different path to success. A "Dubai Studio Apartment for sale" in a hotspot like Dubai Marina is a magnet for rental income. On the flip side, if you're thinking long-term, you can't go wrong with communities like Dubai Hills Estate. A spacious "Dubai Villa for Sale" here is a rock-solid investment, designed for families with incredible schools and parks.

Your choice of location directly impacts your return on investment. The constant demand in a place like Business Bay can deliver that fantastic high ROI of up to 10% from rentals, while up-and-coming family communities are primed for high capital appreciation of 5-6% per annum.

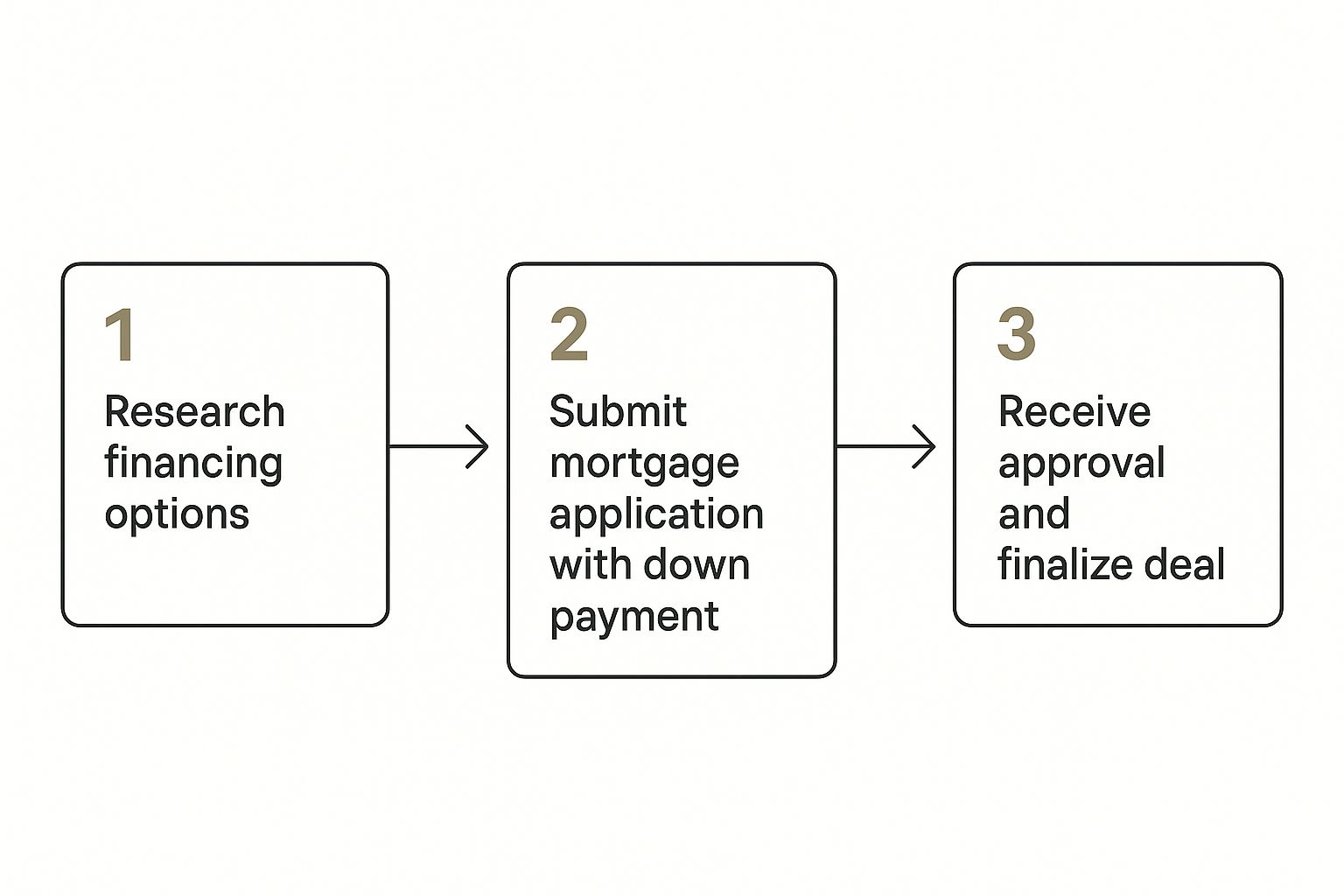

Your Purchase Blueprint: From Offer to Ownership

You’ve found the one. Now for the exciting part: making it yours. The process of making an offer and getting those keys in hand is surprisingly straightforward and secure.

Securing Your Property: The Initial Agreements

The first official step is to formalise your interest with a Memorandum of Understanding (MOU), also called "Form F." This legally binding document spells out every detail – the price, the payment plan, and responsibilities. To lock it in, you'll provide a security deposit cheque, usually 10% of the property's value, held securely by a RERA-registered agent.

The All-Important No Objection Certificate (NOC)

Here's a crucial piece of the puzzle: the No Objection Certificate (NOC). It’s an official document from the developer confirming there are no outstanding service charges or other debts tied to the property. For you, the buyer, this is an absolutely essential safeguard. Getting the NOC is the seller's responsibility and ensures you start with a completely clean slate, which is a key part of our expat property guide to a stress-free purchase.

The NOC is your assurance that you won't inherit any of the previous owner's financial obligations. It’s a fundamental part of Dubai's transparent and investor-friendly legal framework.

The Final Step: Title Deed Transfer

With the MOU signed and the NOC secured, it's time to head to the Dubai Land Department and make it official. You and the seller will meet at a DLD trustee office. You’ll need your documents ready: your passport, the signed MOU, and the original NOC. This is when you'll pay the seller the agreed-upon price and settle the DLD’s 4% transfer fee. Once everything is confirmed, the DLD will issue a brand-new title deed with your name on it. Congratulations! You are officially a Dubai property owner.

Life After the Keys: Unlocking the Dubai Lifestyle

Congratulations! You’re holding the keys to your new Dubai property. Owning a piece of this city is your ticket to a lifestyle that’s secure, luxurious, and globally connected.

Managing Your Investment from Afar

If you won’t be living in your new property, hire a professional property management company. They’ll find and screen top-tier tenants, handle rent collection, and sort out any maintenance, turning your property into a true passive income machine.

Your Dubai property is more than just bricks and mortar; it’s a strategic asset that unlocks long-term personal and financial security. It's your ticket to residency in one of the world's most dynamic and safe cities.

This level of professional support is one of the key reasons why UAE laws favour expats, making remote ownership remarkably straightforward.

Securing Your Future with the Golden Visa

One of the biggest perks of buying property in Dubai for foreigners is the clear path it creates to long-term residency. This is a life-changing opportunity.

- Property Value of AED 750,000+: Qualifies you for a renewable 2-year residency visa.

- Property Value of AED 2 Million+: Makes you eligible for the highly sought-after 10-year Golden Visa.

The Golden Visa is a game-changer. It grants long-term residency for you and your family, allowing you to live, work, and study in the UAE without needing a local sponsor.

Embracing the Dubai Lifestyle

Let’s be honest, living in Dubai is an experience. The city is consistently ranked as one of the safest on the planet, with world-class infrastructure that just works. Life is seamless here.

The international community is incredibly vibrant, creating a welcoming atmosphere for people from every corner of the globe. Indian and British investors, for example, are the biggest foreign buyer groups. Indian buyers make up 22% of foreign purchases, while British investors account for 17%, chasing Dubai’s strong rental yields. You can read more about the top foreign investor nationalities shaping Dubai's market if you're curious. This incredible diversity in demand underpins the market's resilience.

Your Top Questions Answered by Property Experts

Jumping into the Dubai property market is exhilarating, but you probably have questions. Here are answers to the most common queries we hear from international investors.

What Are the Total Upfront Costs When Buying Property in Dubai?

The listing price is just the start. Beyond the purchase price, here’s a realistic breakdown of what you should budget for:

- Dubai Land Department (DLD) Transfer Fee: A flat 4% of the property's value.

- Registration Fees: Around AED 4,200.

- Real Estate Agent’s Commission: Typically 2% of the purchase price, plus VAT.

- Mortgage Fees: If financing, expect a mortgage registration fee of 0.25% of the loan amount, plus bank processing fees.

A good rule of thumb is to set aside an extra 7-8% of the property’s value to cover all associated costs comfortably.

What Taxes Will I Pay on My Dubai Property?

This is where Dubai’s property market leaves other global cities in the dust. The impact of taxes in property investment is a dream for investors.

It’s breathtakingly simple:

- Zero annual property taxes.

- Zero income tax on rental earnings.

- Zero capital gains tax when you sell.

This tax-free environment is what truly supercharges your investment. It means that the fantastic ROI of up to 10% you can earn from rent, plus the 5-6% per year in capital growth, goes straight into your pocket.

Is It Better to Buy an Off-Plan or a Ready Property?

There's no single right answer—it all comes down to your personal goals.

Off-Plan Properties

This means you're buying directly from a developer before the property is built. The upside is a lower entry price and flexible payment plans, with huge potential for high capital appreciation. The downside is the longer wait and the risk tied to construction timelines.

Ready Properties

These are existing homes on the secondary market. The biggest win is immediate returns—you can rent it out or move in right away. The risk is lower, but the purchase price is usually higher with less payment flexibility.

If your main goal is to maximise capital growth, off-plan can be rewarding. But if you prioritise immediate, steady cash flow and peace of mind, a ready property is your best bet.

Ready to find your perfect property and unlock the incredible lifestyle and investment potential Dubai has to offer? The team at Emerald Estates Properties LLC is here to guide you every step of the way. Explore our exclusive listings and start your journey today!